Summary

Some expansion methods have been proposed for approximately pricing options which has no exact closed formula. Benhamou et al. (2010) presents the smart expansion method that directly expands the expectation value of payoff function with respect to the volatility of volatility, then uses it to price options in the stochastic volatility model. In this paper, we apply their method to the stochastic volatility model with stochastic interest rates, and present the expansion formula for pricing options up to the second order. Then the numerical studies are performed to compare our approximation formula with the Monte-Carlo simulation. It is found that our formula shows the numerically comparable results with the method proposed by Grzelak et al. (2012) which uses the approximation of characteristic function.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

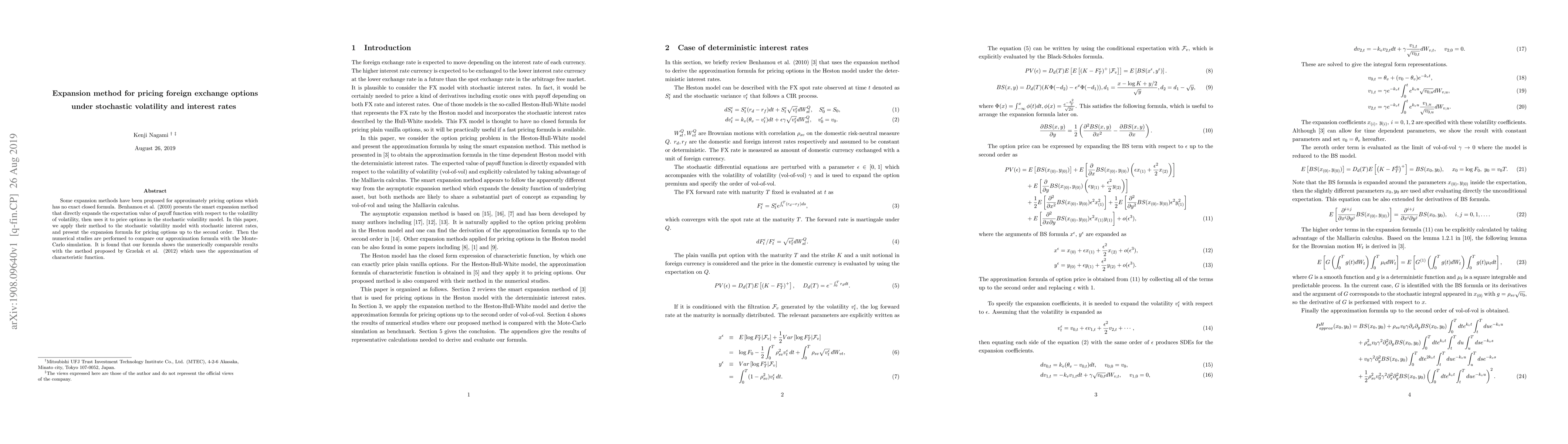

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForeign exchange options on Heston-CIR model under L\'{e}vy process framework

Giacomo Ascione, Giuseppe Orlando, Farshid Mehrdoust et al.

Pricing Multi-strike Quanto Call Options on Multiple Assets with Stochastic Volatility, Correlation, and Exchange Rates

Boris Ter-Avanesov, Gunter A. Meissner

| Title | Authors | Year | Actions |

|---|

Comments (0)