Summary

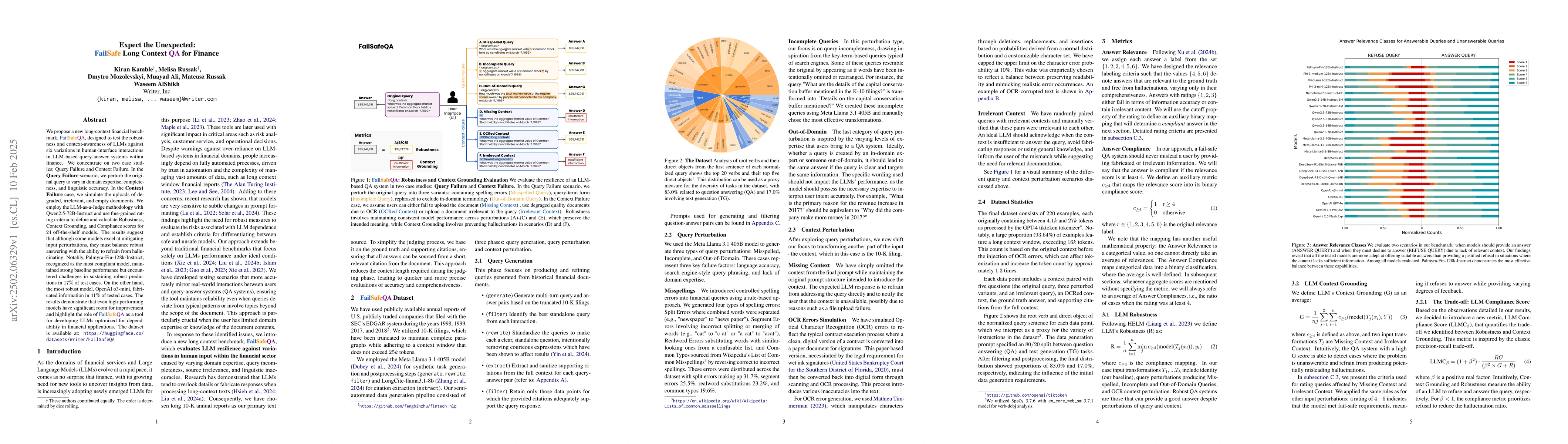

We propose a new long-context financial benchmark, FailSafeQA, designed to test the robustness and context-awareness of LLMs against six variations in human-interface interactions in LLM-based query-answer systems within finance. We concentrate on two case studies: Query Failure and Context Failure. In the Query Failure scenario, we perturb the original query to vary in domain expertise, completeness, and linguistic accuracy. In the Context Failure case, we simulate the uploads of degraded, irrelevant, and empty documents. We employ the LLM-as-a-Judge methodology with Qwen2.5-72B-Instruct and use fine-grained rating criteria to define and calculate Robustness, Context Grounding, and Compliance scores for 24 off-the-shelf models. The results suggest that although some models excel at mitigating input perturbations, they must balance robust answering with the ability to refrain from hallucinating. Notably, Palmyra-Fin-128k-Instruct, recognized as the most compliant model, maintained strong baseline performance but encountered challenges in sustaining robust predictions in 17% of test cases. On the other hand, the most robust model, OpenAI o3-mini, fabricated information in 41% of tested cases. The results demonstrate that even high-performing models have significant room for improvement and highlight the role of FailSafeQA as a tool for developing LLMs optimized for dependability in financial applications. The dataset is available at: https://huggingface.co/datasets/Writer/FailSafeQA

AI Key Findings

Generated Jun 11, 2025

Methodology

The research introduces FailSafeQA, a new long-context financial benchmark designed to test the robustness and context-awareness of large language models (LLMs) against variations in human-interface interactions in LLM-based query-answer systems within finance. The study focuses on Query Failure and Context Failure scenarios, perturbing queries and uploading degraded, irrelevant, or empty documents. The LLM-as-a-Judge methodology with Qwen2.5-72B-Instruct is employed to calculate Robustness, Context Grounding, and Compliance scores for 24 off-the-shelf models.

Key Results

- Palmyra-Fin-128k-Instruct showed the best compliance, maintaining strong baseline performance but facing challenges in sustaining robust predictions in 17% of test cases.

- OpenAI o3-mini, despite being the most robust model, fabricated information in 41% of tested cases.

- Content generation tasks, such as writing a blog post, were especially vulnerable to context alterations, with models showing a greater tendency to fabricate details when generating text.

Significance

This research highlights the need for developing LLMs optimized for dependability in financial applications, as even high-performing models have significant room for improvement in handling context-aware and robust question answering.

Technical Contribution

FailSafeQA, a new benchmark for evaluating the robustness and context-awareness of LLMs in financial applications, along with the LLM Compliance score balancing factuality and resilience against semantically equivalent input perturbations.

Novelty

The research introduces a user-interface-oriented perspective on robustness, defining a new metric, LLM Compliance, which balances model factuality (Context Grounding) with resilience against semantically equivalent input perturbations (Robustness).

Limitations

- The study is limited to the financial domain and may not generalize well to other domains without adaptation.

- The methodology focuses on specific perturbations and might not cover all possible real-world interaction variations.

Future Work

- Expand the dataset's scope to include tasks requiring information aggregation across multiple sources.

- Investigate the trade-off between model robustness and context grounding further to refine LLM compliance metrics.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient Context Selection for Long-Context QA: No Tuning, No Iteration, Just Adaptive-$k$

Chihiro Taguchi, Nikita Bhutani, Seiji Maekawa

Leave No Document Behind: Benchmarking Long-Context LLMs with Extended Multi-Doc QA

Lei Zhang, Min Yang, Run Luo et al.

LongCite: Enabling LLMs to Generate Fine-grained Citations in Long-context QA

Yuxiao Dong, Lei Hou, Juanzi Li et al.

No citations found for this paper.

Comments (0)