Summary

The present paper provides the basis for a novel financial asset pricing model that could avoid the shortcomings of, or even completely replace the traditional DCF model. The model is based on Brownian motion logic and expected future cash flow values. It can be very useful for Islamic Finance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

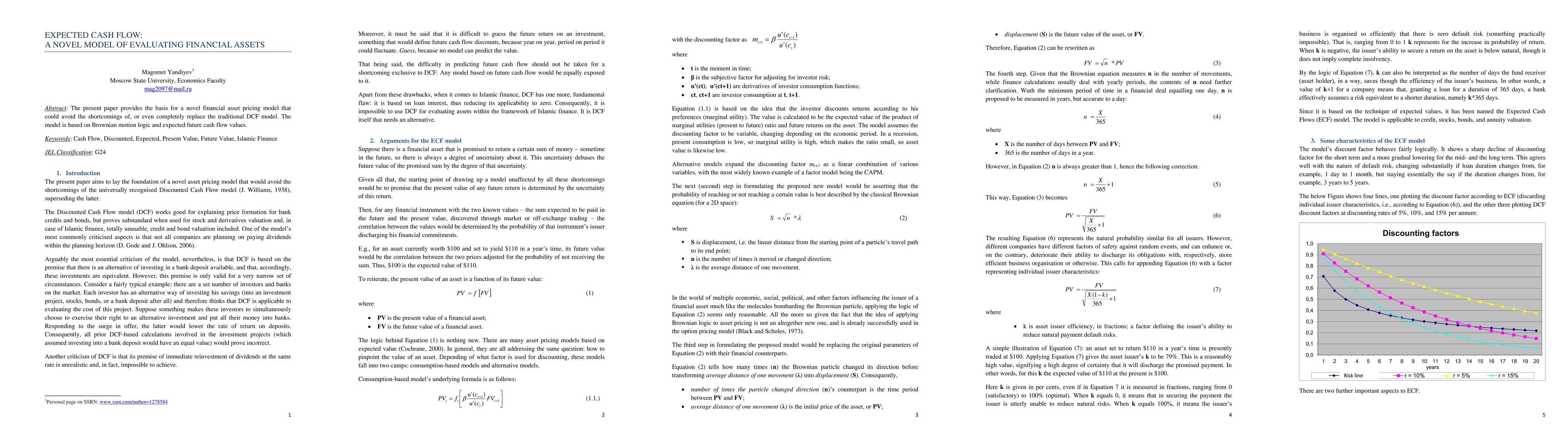

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)