Summary

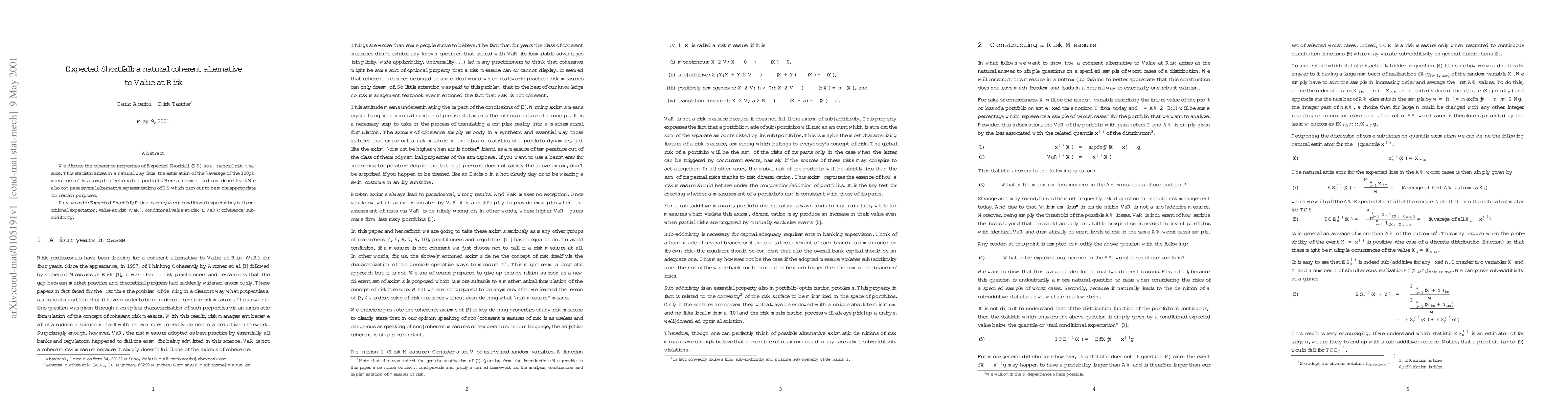

We discuss the coherence properties of Expected Shortfall (ES) as a financial risk measure. This statistic arises in a natural way from the estimation of the "average of the 100p % worst losses" in a sample of returns to a portfolio. Here p is some fixed confidence level. We also compare several alternative representations of ES which turn out to be more appropriate for certain purposes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)