Summary

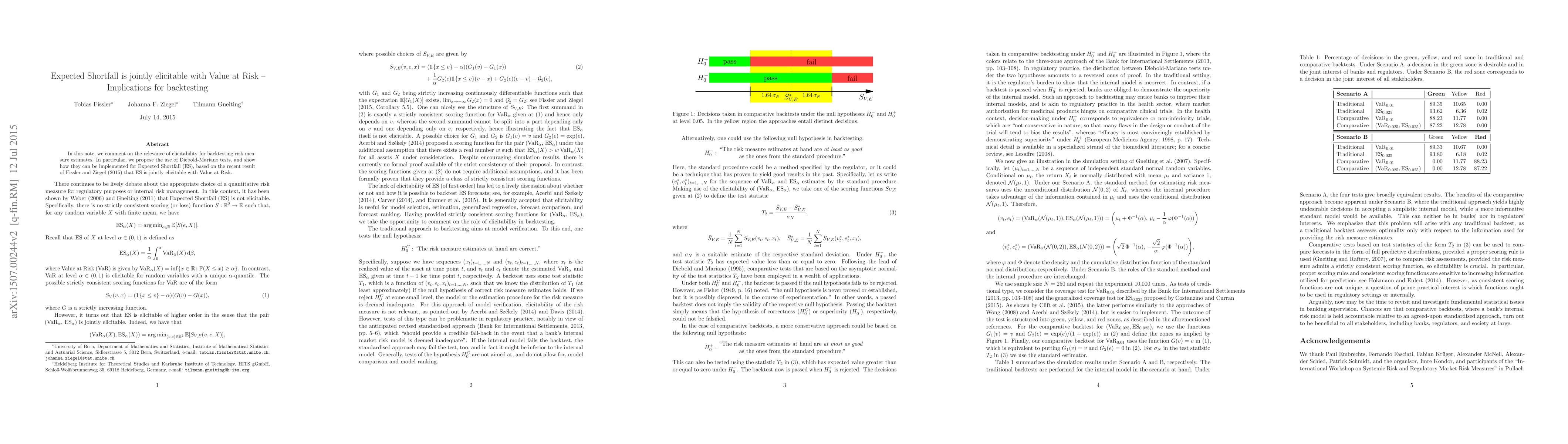

In this note, we comment on the relevance of elicitability for backtesting risk measure estimates. In particular, we propose the use of Diebold-Mariano tests, and show how they can be implemented for Expected Shortfall (ES), based on the recent result of Fissler and Ziegel (2015) that ES is jointly elicitable with Value at Risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)