Summary

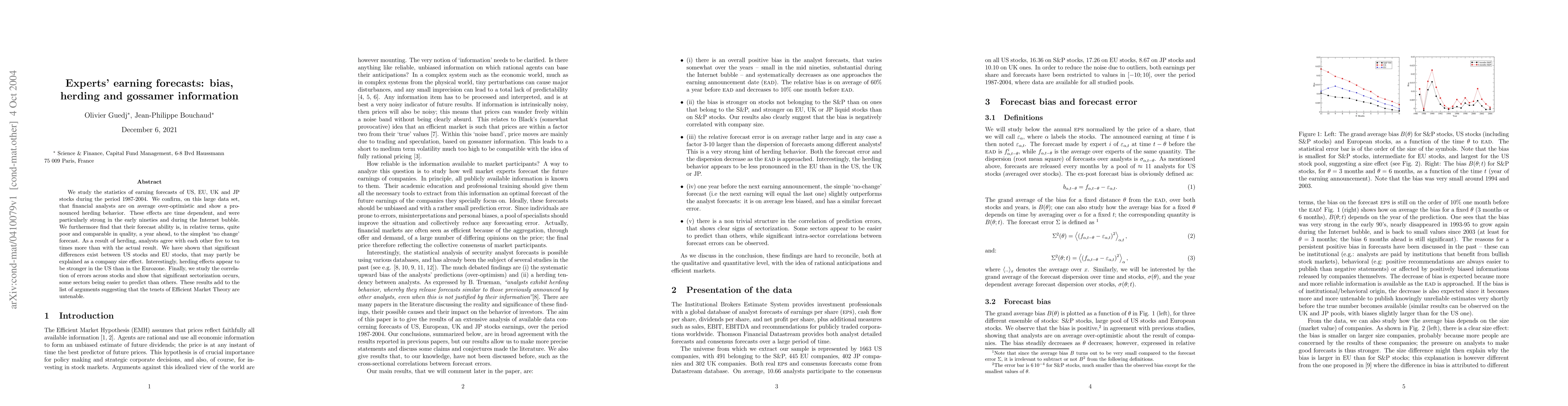

We study the statistics of earning forecasts of US, EU, UK and JP stocks during the period 1987-2004. We confirm, on this large data set, that financial analysts are on average over-optimistic and show a pronounced herding behavior. These effects are time dependent, and were particularly strong in the early nineties and during the Internet bubble. We furthermore find that their forecast ability is, in relative terms, quite poor and comparable in quality, a year ahead, to the simplest `no change' forecast. As a result of herding, analysts agree with each other five to ten times more than with the actual result. We have shown that significant differences exist between US stocks and EU stocks, that may partly be explained as a company size effect. Interestingly, herding effects appear to be stronger in the US than in the Eurozone. Finally, we study the correlation of errors across stocks and show that significant sectorization occurs, some sectors being easier to predict than others. These results add to the list of arguments suggesting that the tenets of Efficient Market Theory are untenable.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)