Authors

Summary

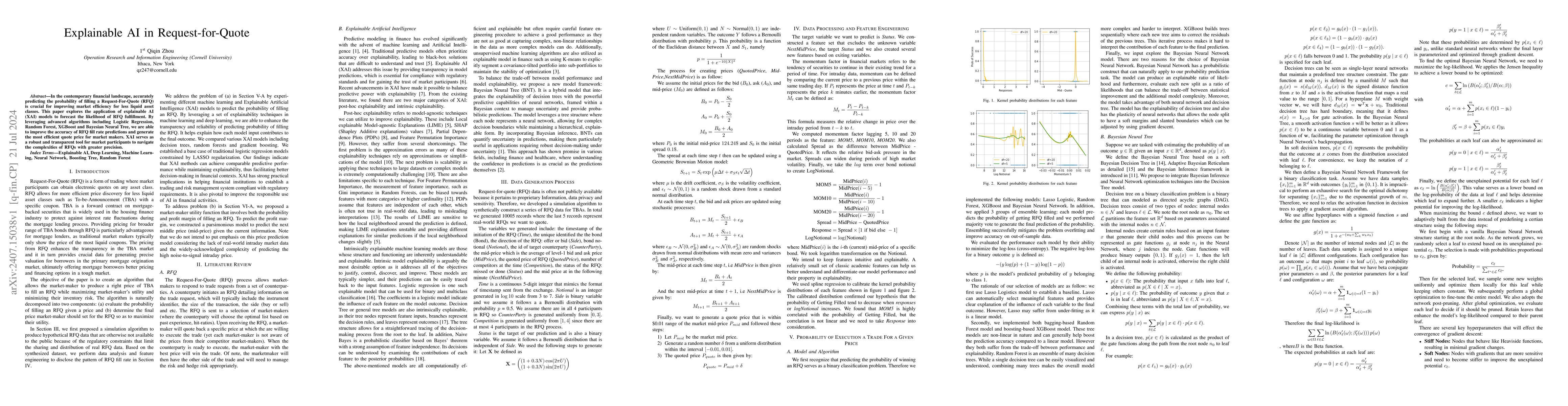

In the contemporary financial landscape, accurately predicting the probability of filling a Request-For-Quote (RFQ) is crucial for improving market efficiency for less liquid asset classes. This paper explores the application of explainable AI (XAI) models to forecast the likelihood of RFQ fulfillment. By leveraging advanced algorithms including Logistic Regression, Random Forest, XGBoost and Bayesian Neural Tree, we are able to improve the accuracy of RFQ fill rate predictions and generate the most efficient quote price for market makers. XAI serves as a robust and transparent tool for market participants to navigate the complexities of RFQs with greater precision.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuOTE: Question-Oriented Text Embeddings

Naren Ramakrishnan, Andrew Neeser, Kaylen Latimer et al.

Explainable AI improves task performance in human-AI collaboration

Stefan Feuerriegel, Julian Senoner, Simon Schallmoser et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)