Authors

Summary

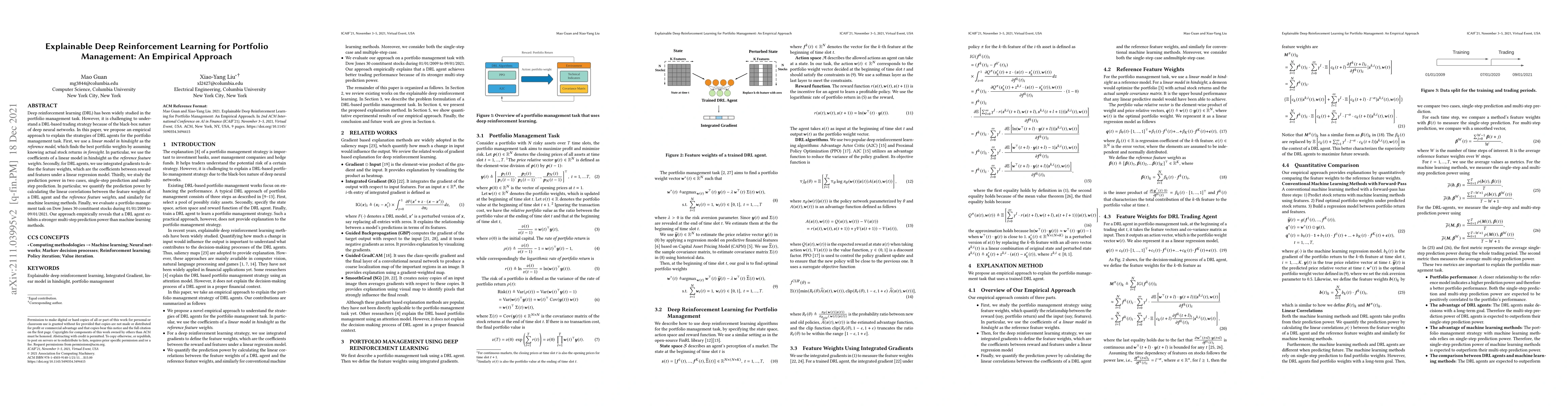

Deep reinforcement learning (DRL) has been widely studied in the portfolio management task. However, it is challenging to understand a DRL-based trading strategy because of the black-box nature of deep neural networks. In this paper, we propose an empirical approach to explain the strategies of DRL agents for the portfolio management task. First, we use a linear model in hindsight as the reference model, which finds the best portfolio weights by assuming knowing actual stock returns in foresight. In particular, we use the coefficients of a linear model in hindsight as the reference feature weights. Secondly, for DRL agents, we use integrated gradients to define the feature weights, which are the coefficients between reward and features under a linear regression model. Thirdly, we study the prediction power in two cases, single-step prediction and multi-step prediction. In particular, we quantify the prediction power by calculating the linear correlations between the feature weights of a DRL agent and the reference feature weights, and similarly for machine learning methods. Finally, we evaluate a portfolio management task on Dow Jones 30 constituent stocks during 01/01/2009 to 09/01/2021. Our approach empirically reveals that a DRL agent exhibits a stronger multi-step prediction power than machine learning methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExplainable Post hoc Portfolio Management Financial Policy of a Deep Reinforcement Learning agent

Alejandra de la Rica Escudero, Eduardo C. Garrido-Merchan, Maria Coronado-Vaca

| Title | Authors | Year | Actions |

|---|

Comments (0)