Authors

Summary

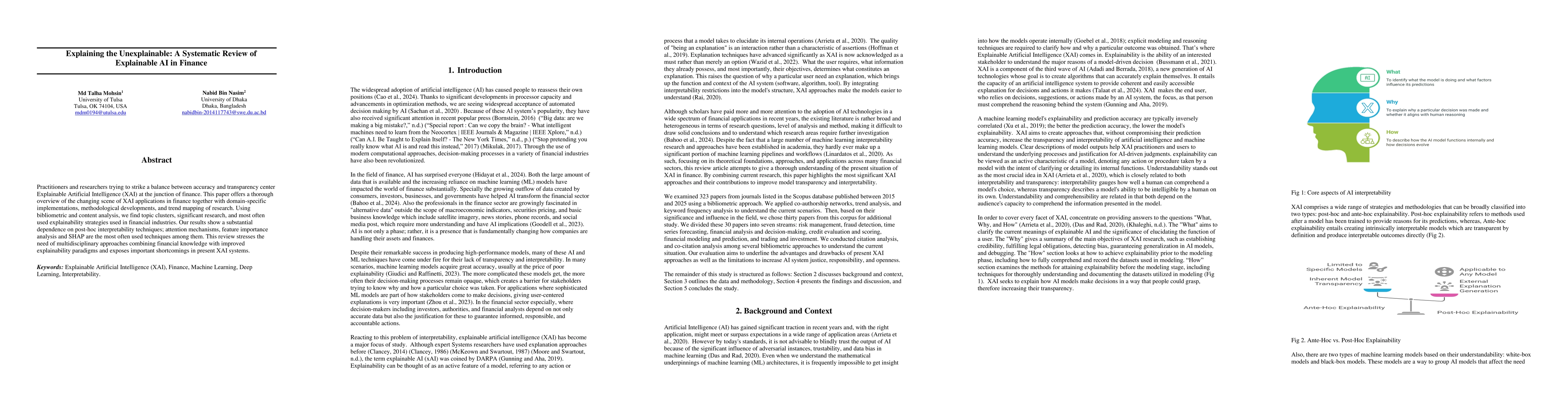

Practitioners and researchers trying to strike a balance between accuracy and transparency center Explainable Artificial Intelligence (XAI) at the junction of finance. This paper offers a thorough overview of the changing scene of XAI applications in finance together with domain-specific implementations, methodological developments, and trend mapping of research. Using bibliometric and content analysis, we find topic clusters, significant research, and most often used explainability strategies used in financial industries. Our results show a substantial dependence on post-hoc interpretability techniques; attention mechanisms, feature importance analysis and SHAP are the most often used techniques among them. This review stresses the need of multidisciplinary approaches combining financial knowledge with improved explainability paradigms and exposes important shortcomings in present XAI systems.

AI Key Findings

Generated Jun 10, 2025

Methodology

This systematic review uses bibliometric and content analysis to offer an overview of Explainable AI (XAI) applications in finance, identifying topic clusters, significant research, and commonly used explainability strategies.

Key Results

- There is a substantial dependence on post-hoc interpretability techniques.

- Attention mechanisms, feature importance analysis, and SHAP are the most frequently used techniques.

- Multidisciplinary approaches combining financial knowledge with improved explainability paradigms are emphasized.

- Important shortcomings in current XAI systems are exposed.

- A significant increase in XAI research in finance post-2019 is observed.

Significance

This research highlights the need for transparent and interpretable financial models, which is crucial for generating trust, ensuring fairness, and meeting regulatory obligations in the financial sector.

Technical Contribution

The paper presents a comprehensive review of XAI methodologies in finance, identifying trends, developments, and applications of explainability techniques.

Novelty

This work distinguishes itself by providing a systematic review of XAI in finance, focusing on methodological developments, domain-specific implementations, and the most often used explainability strategies.

Limitations

- Limited real-time application in some studies.

- Need for further exploration of model behavior in others.

- Dataset constraints in certain research.

- High computational costs in studies with complex model architectures.

Future Work

- Investigate XAI approaches within the context of finance to address challenges and support ethical AI deployment.

- Develop stronger, more scalable, and domain-specific explainability solutions to overcome current shortcomings.

- Enhance interpretability and transparency to boost confidence in AI models for wider real-world applications.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Comprehensive Review on Financial Explainable AI

Rui Mao, Gianmarco Mengaldo, Erik Cambria et al.

Explainable AI for Safe and Trustworthy Autonomous Driving: A Systematic Review

Cheng Wang, Anton Kuznietsov, Balint Gyevnar et al.

No citations found for this paper.

Comments (0)