Summary

We investigate two hedging problems in exponential L\'evy models. First, we provide an explicit representation for the F\"ollmer--Schweizer decomposition of European type options under mild conditions, which implies a closed-form expression of the corresponding local risk-minimizing strategies. Secondly, we discretize stochastic integrals driven by an exponential L\'evy process using a jump correction method. The convergence rate of the resulting discretization error as the expected number of discretization times increases is measured in weighted BMO spaces, implying also $L_p$-estimates, $p \in (2, \infty)$. Moreover, the effect of a change of measure satisfying a reverse H\"older inequality is addressed. As an application, the error caused by discretizing the local risk-minimizing strategies is investigated in dependence of properties of the L\'evy measure, the regularity of the payoff function and the chosen random discretization times.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

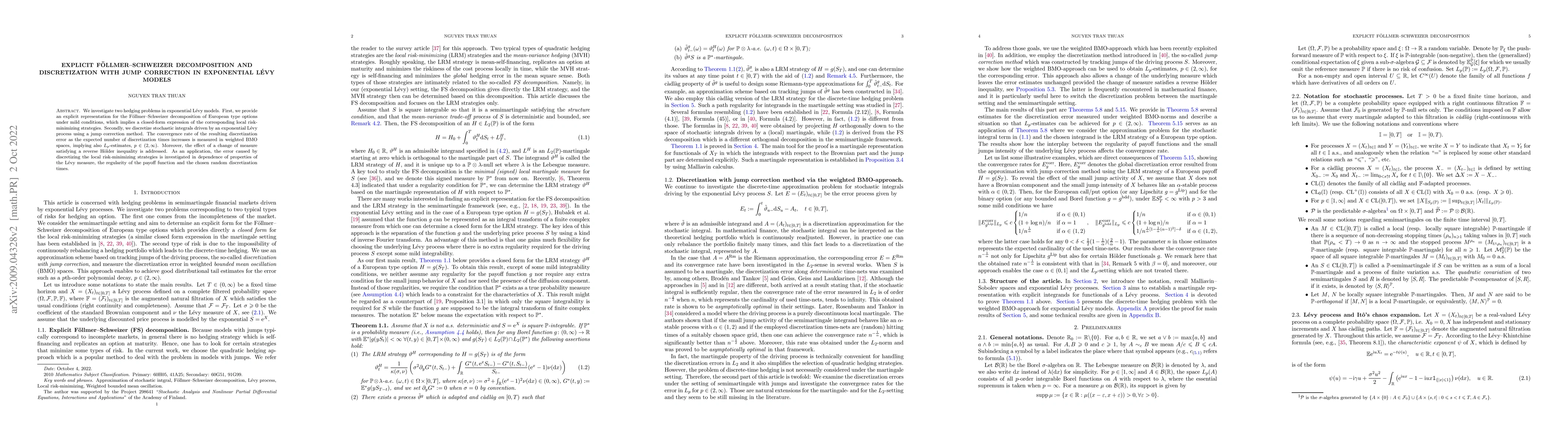

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)