Authors

Summary

This paper focuses on mean-square approximations of a generalized A\"it-Sahalia interest rate model with Poisson jumps. The main challenge in the construction and analysis of time-discrete numerical schemes is caused by a drift that blows up at the origin, highly nonlinear drift and diffusion coefficients and positivity-preserving requirement. Due to the presence of the Poisson jumps, additional difficulties arise in recovering the exact order $1/2$ of convergence for the time-stepping schemes. By incorporating implicitness in the term $\alpha_{-1}x^{-1} $ and introducing the modifications functions $f_h$ and $g_h$ in the recursion, a novel explicit Euler-type scheme is proposed, which is easy to implement and preserves the positivity of the original model unconditionally, i.e., for any time step-size $h>0$. A mean-square convergence rate of order $1/2$ is established for the proposed scheme in both the non-critical and general critical cases. Finally, numerical experiments are provided to confirm the theoretical findings.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

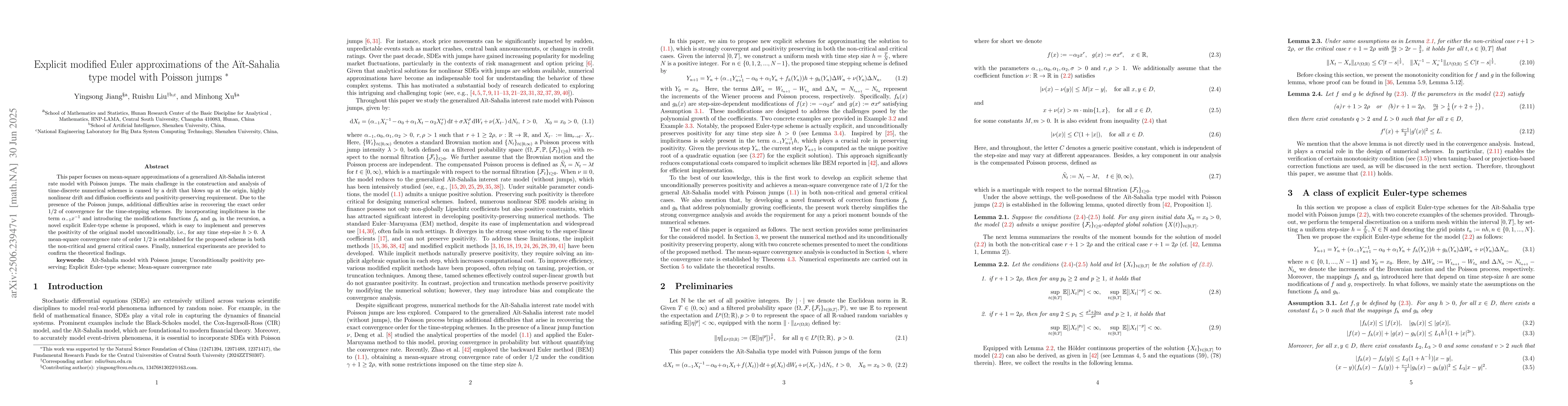

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFirst order strong approximation of Ait-Sahalia-type interest rate model with Poisson jumps

Jing Liu, Ziyi Lei, Siqing Gan

Unconditionally positivity-preserving explicit Euler-type schemes for a generalized Ait-Sahalia model

Xiaojie Wang, Ruishu Liu, Yulin Cao

Unconditionally positivity-preserving approximations of the Ait-Sahalia type model: Explicit Milstein-type schemes

Xiaojie Wang, Yingsong Jiang, Ruishu Liu et al.

No citations found for this paper.

Comments (0)