Summary

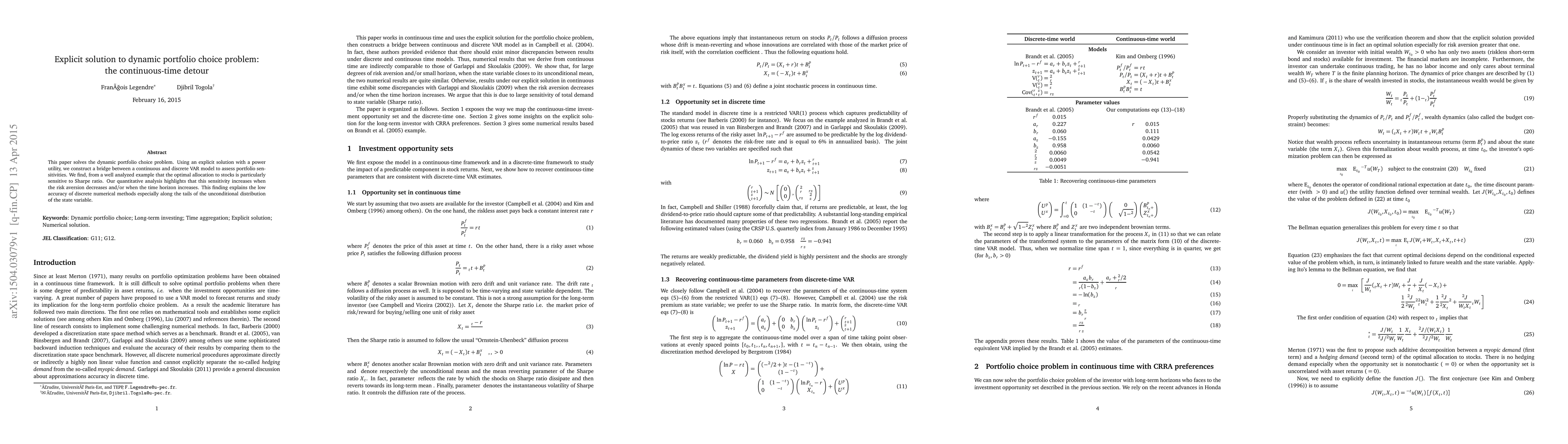

This paper solves the dynamic portfolio choice problem. Using an explicit solution with a power utility, we construct a bridge between a continuous and discrete VAR model to assess portfolio sensitivities. We find, from a well analyzed example that the optimal allocation to stocks is particularly sensitive to Sharpe ratio. Our quantitative analysis highlights that this sensitivity increases when the risk aversion decreases and/or when the time horizon increases. This finding explains the low accuracy of discrete numerical methods especially along the tails of the unconditional distribution of the state variable.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic growth-optimum portfolio choice under risk control

Zuo Quan Xu, Pengyu Wei

A Closed-Form Solution of the Multi-Period Portfolio Choice Problem for a Quadratic Utility Function

Wolfgang Schmid, Taras Bodnar, Nestor Parolya

No citations found for this paper.

Comments (0)