Summary

In this paper, we investigate a class of nonlinear backward stochastic differential equations (BSDEs) arising from financial economics, and give specific information about the nodal sets of the related solutions. As applications, we are able to obtain the explicit solutions to an interesting class of nonlinear BSDEs including the k-ignorance BSDE arising from the modeling of ambiguity of asset pricing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

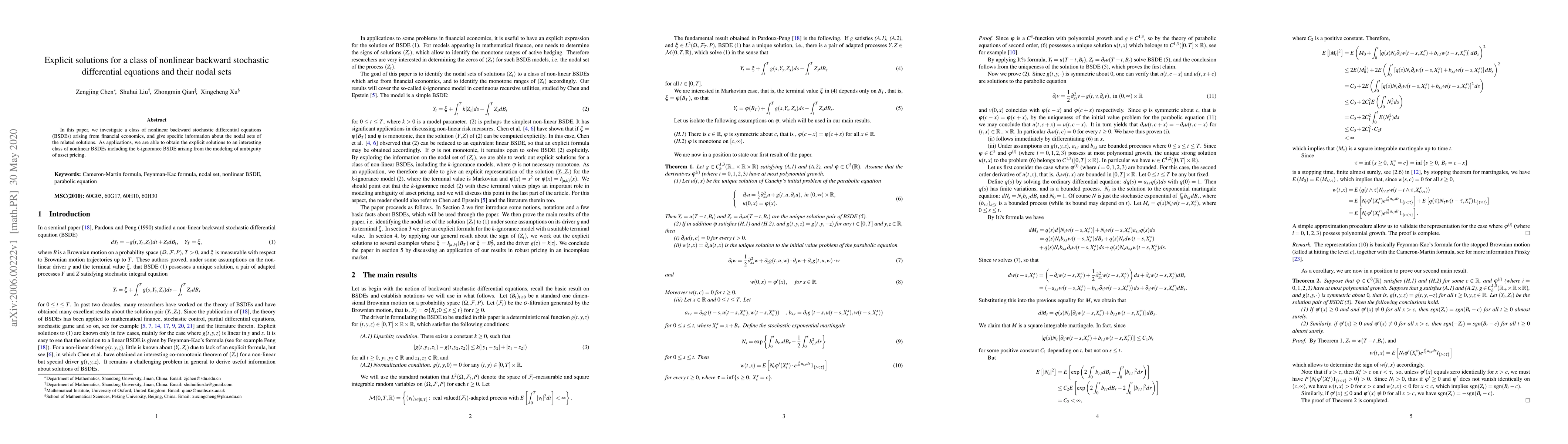

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)