Summary

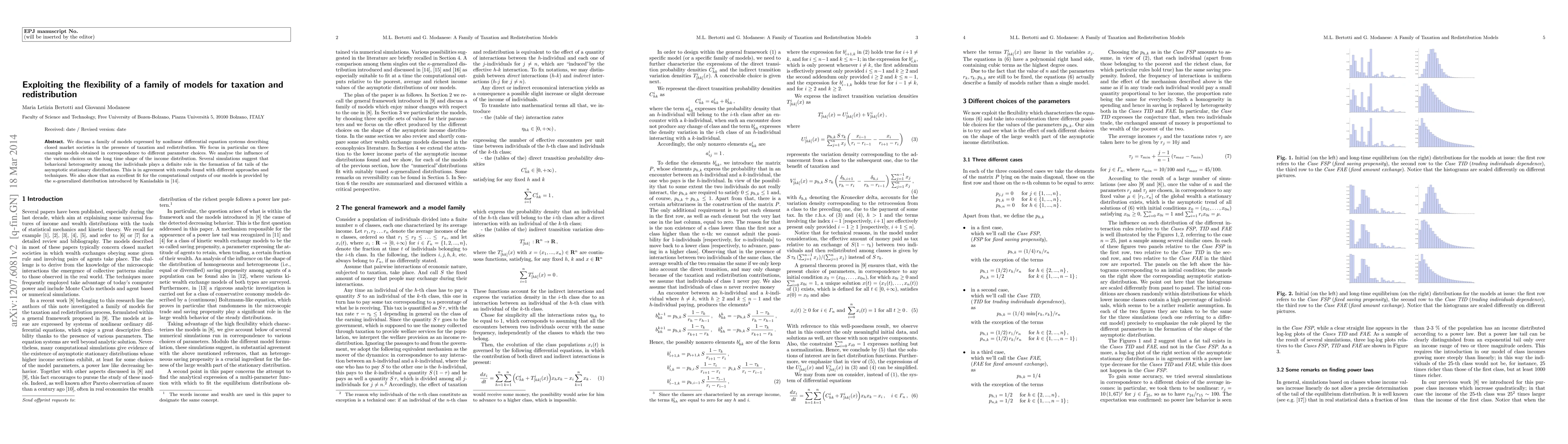

We discuss a family of models expressed by nonlinear differential equation systems describing closed market societies in the presence of taxation and redistribution. We focus in particular on three example models obtained in correspondence to different parameter choices. We analyse the influence of the various choices on the long time shape of the income distribution. Several simulations suggest that behavioral heterogeneity among the individuals plays a definite role in the formation of fat tails of the asymptotic stationary distributions. This is in agreement with results found with different approaches and techniques. We also show that an excellent fit for the computational outputs of our models is provided by the k-generalized distribution introduced by G. Kaniadakis (Physica A 296 (2001) 405-425).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUniform taxation of electricity: incentives for flexibility and cost redistribution among household categories

Dogan Keles, Philipp Andreas Gunkel, Claire-Marie Bergaentzlé et al.

ODE models of wealth concentration and taxation

Christoph Börgers, Bruce Boghosian

Automation and Taxation

Kerstin Hötte, Pantelis Koutroumpis, Angelos Theodorakopoulos

No citations found for this paper.

Comments (0)