Summary

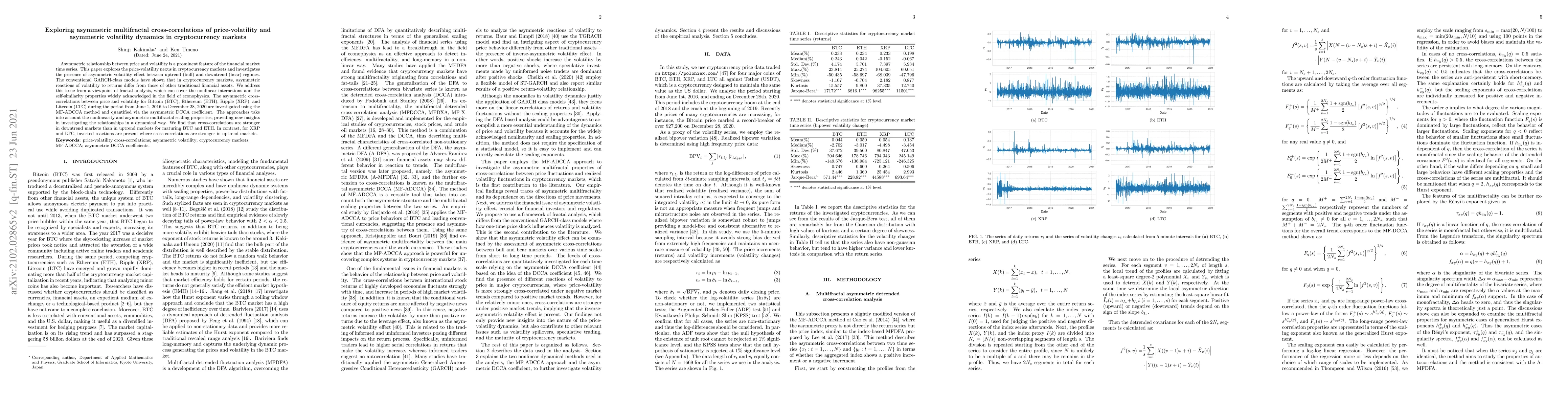

Asymmetric relationship between price and volatility is a prominent feature of the financial market time series. This paper explores the price-volatility nexus in cryptocurrency markets and investigates the presence of asymmetric volatility effect between uptrend (bull) and downtrend (bear) regimes. The conventional GARCH-class models have shown that in cryptocurrency markets, asymmetric reactions of volatility to returns differ from those of other traditional financial assets. We address this issue from a viewpoint of fractal analysis, which can cover the nonlinear interactions and the self-similarity properties widely acknowledged in the field of econophysics. The asymmetric cross-correlations between price and volatility for Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Litecoin (LTC) during the period from June 1, 2016 to December 28, 2020 are investigated using the MF-ADCCA method and quantified via the asymmetric DCCA coefficient. The approaches take into account the nonlinearity and asymmetric multifractal scaling properties, providing new insights in investigating the relationships in a dynamical way. We find that cross-correlations are stronger in downtrend markets than in uptrend markets for maturing BTC and ETH. In contrast, for XRP and LTC, inverted reactions are present where cross-correlations are stronger in uptrend markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)