Authors

Summary

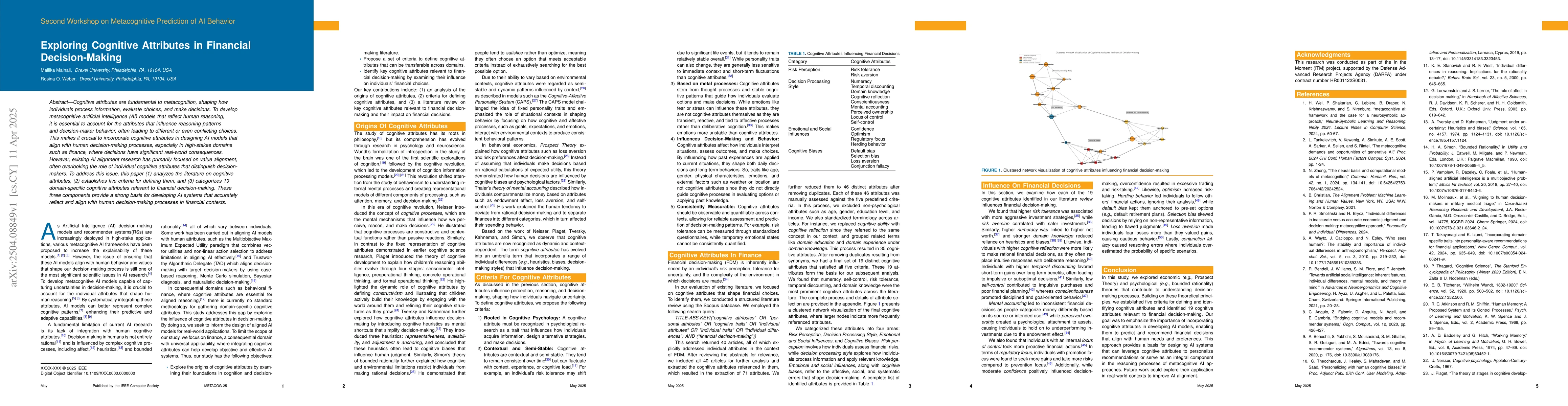

Cognitive attributes are fundamental to metacognition, shaping how individuals process information, evaluate choices, and make decisions. To develop metacognitive artificial intelligence (AI) models that reflect human reasoning, it is essential to account for the attributes that influence reasoning patterns and decision-maker behavior, often leading to different or even conflicting choices. This makes it crucial to incorporate cognitive attributes in designing AI models that align with human decision-making processes, especially in high-stakes domains such as finance, where decisions have significant real-world consequences. However, existing AI alignment research has primarily focused on value alignment, often overlooking the role of individual cognitive attributes that distinguish decision-makers. To address this issue, this paper (1) analyzes the literature on cognitive attributes, (2) establishes five criteria for defining them, and (3) categorizes 19 domain-specific cognitive attributes relevant to financial decision-making. These three components provide a strong basis for developing AI systems that accurately reflect and align with human decision-making processes in financial contexts.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research methodology involved a literature review using the Scopus database, focusing on articles that addressed individual attributes in the context of financial decision-making. The study aimed to identify cognitive attributes that shape financial choices and categorize them based on five predefined criteria.

Key Results

- The study identified 19 distinct cognitive attributes relevant to financial decision-making, categorized into four areas: Risk Perception, Decision Processing Style, Emotional and Social Influences, and Cognitive Biases.

- Higher risk tolerance was associated with more aggressive investment strategies, while risk aversion correlated with safer investments.

- Numeracy, self-control, risk tolerance, temporal discounting, and domain knowledge were found to be the most prominent cognitive attributes across the literature.

Significance

This research emphasizes the importance of incorporating cognitive attributes in developing AI models to predict and recommend financial decisions that align with human needs and preferences, thereby improving AI alignment in financial contexts.

Technical Contribution

The paper proposes five criteria for defining and identifying cognitive attributes, providing a framework for developing AI systems that reflect human decision-making processes in financial contexts.

Novelty

This research distinguishes itself by focusing on cognitive attributes in financial decision-making, establishing criteria for their identification, and categorizing 19 relevant attributes, which have not been comprehensively analyzed in previous literature.

Limitations

- The study primarily relied on existing literature, which might not capture all nuances of cognitive attributes in financial decision-making.

- The research did not include empirical data to validate the identified cognitive attributes in real-world financial decision-making scenarios.

Future Work

- Exploring the application of these cognitive attributes in real-world contexts to further improve AI alignment.

- Investigating the dynamic nature of cognitive attributes and their fluctuation based on context, experience, or cognitive load.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCognitive Debiasing Large Language Models for Decision-Making

Zhaochun Ren, Maarten de Rijke, Zihan Wang et al.

Exploring Conversational Agents as an Effective Tool for Measuring Cognitive Biases in Decision-Making

Stephen Pilli

A Comparison Between Human and Generative AI Decision-Making Attributes in Complex Health Services

Nandini Doreswamy, Louise Horstmanshof

No citations found for this paper.

Comments (0)