Summary

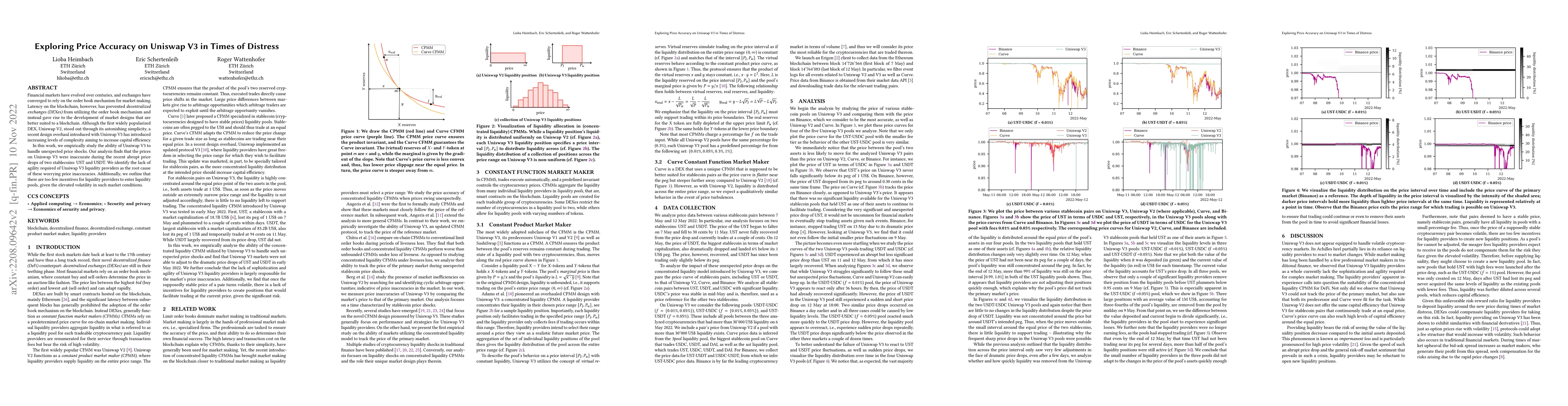

Financial markets have evolved over centuries, and exchanges have converged to rely on the order book mechanism for market making. Latency on the blockchain, however, has prevented decentralized exchanges (DEXes) from utilizing the order book mechanism and instead gave rise to the development of market designs that are better suited to a blockchain. Although the first widely popularized DEX, Uniswap V2, stood out through its astonishing simplicity, a recent design overhaul introduced with Uniswap V3 has introduced increasing levels of complexity aiming to increase capital efficiency. In this work, we empirically study the ability of Unsiwap V3 to handle unexpected price shocks. Our analysis finds that the prices on Uniswap V3 were inaccurate during the recent abrupt price drops of two stablecoins: UST and USDT. We identify the lack of agility required of Unsiwap V3 liquidity providers as the root cause of these worrying price inaccuracies. Additionally, we outline that there are too few incentives for liquidity providers to enter liquidity pools, given the elevated volatility in such market conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisks and Returns of Uniswap V3 Liquidity Providers

Roger Wattenhofer, Lioba Heimbach, Eric Schertenleib

Differential Liquidity Provision in Uniswap v3 and Implications for Contract Design

David C. Parkes, He Sun, Xintong Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)