Summary

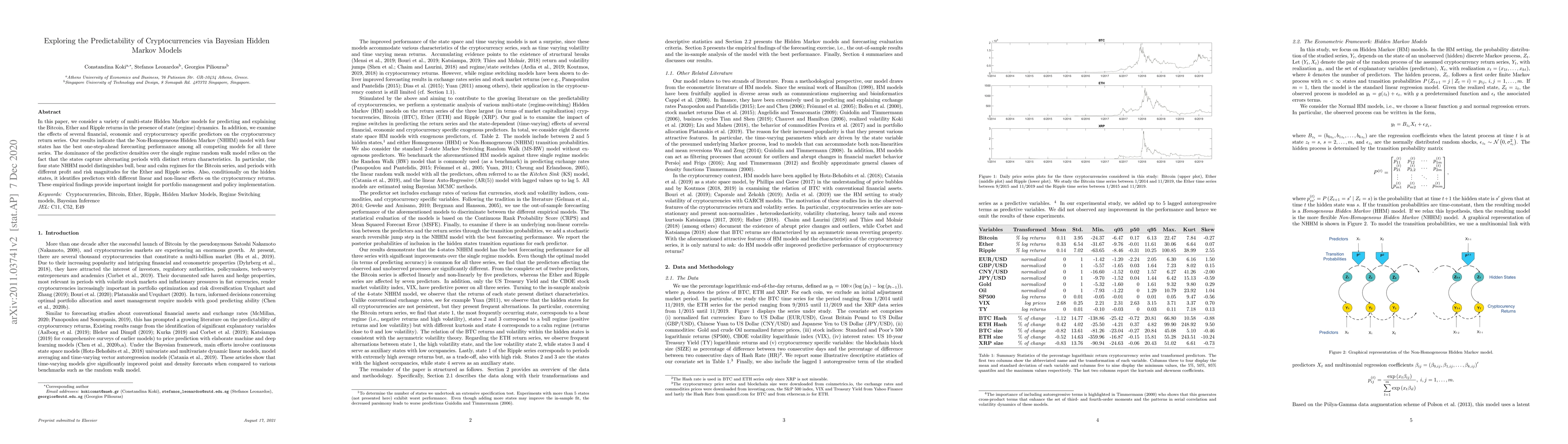

In this paper, we consider a variety of multi-state Hidden Markov models for predicting and explaining the Bitcoin, Ether and Ripple returns in the presence of state (regime) dynamics. In addition, we examine the effects of several financial, economic and cryptocurrency specific predictors on the cryptocurrency return series. Our results indicate that the Non-Homogeneous Hidden Markov (NHHM) model with four states has the best one-step-ahead forecasting performance among all competing models for all three series. The dominance of the predictive densities over the single regime random walk model relies on the fact that the states capture alternating periods with distinct return characteristics. In particular, the four state NHHM model distinguishes bull, bear and calm regimes for the Bitcoin series, and periods with different profit and risk magnitudes for the Ether and Ripple series. Also, conditionally on the hidden states, it identifies predictors with different linear and non-linear effects on the cryptocurrency returns. These empirical findings provide important insight for portfolio management and policy implementation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSequential Bayesian Learning for Hidden Semi-Markov Models

Konstantinos Kalogeropoulos, Patrick Aschermayr

| Title | Authors | Year | Actions |

|---|

Comments (0)