Summary

Exponential functionals of Brownian motion have been extensively studied in financial and insurance mathematics due to their broad applications, for example, in the pricing of Asian options. The Black-Scholes model is appealing because of mathematical tractability, yet empirical evidence shows that geometric Brownian motion does not adequately capture features of market equity returns. One popular alternative for modeling equity returns consists in replacing the geometric Brownian motion by an exponential of a Levy process. In this paper we use this latter model to study variable annuity guaranteed benefits and to compute explicitly the distribution of certain exponential functionals.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

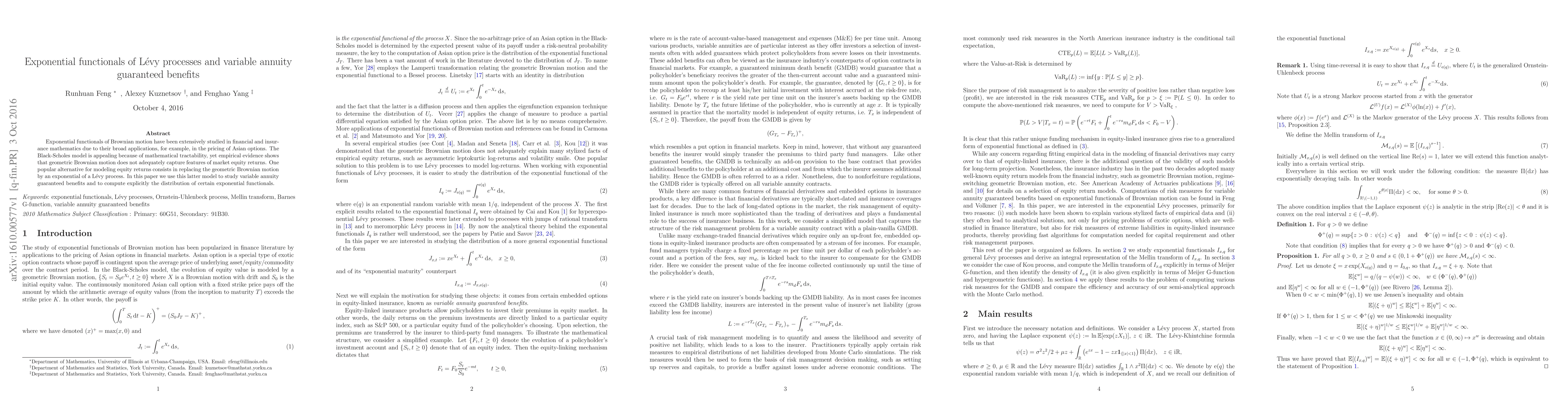

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)