Summary

The Tick library allows researchers in market microstructure to simulate and learn Hawkes process in high-frequency data, with optimized parametric and non-parametric learners. But one challenge is to take into account the correct causality of order book events considering latency: the only way one order book event can influence another is if the time difference between them (by the central order book timestamps) is greater than the minimum amount of time for an event to be (i) published in the order book, (ii) reach the trader responsible for the second event, (iii) influence the decision (processing time at the trader) and (iv) the 2nd event reach the order book and be processed. For this we can use exponential kernels shifted to the right by the latency amount. We derive the expression for the log-likelihood to be minimized for the 1-D and the multidimensional cases, and test this method with simulated data and real data. On real data we find that, although not all decays are the same, the latency itself will determine most of the decays. We also show how the decays are related to the latency. Code is available on GitHub at https://github.com/MarcosCarreira/Hawkes-With-Latency.

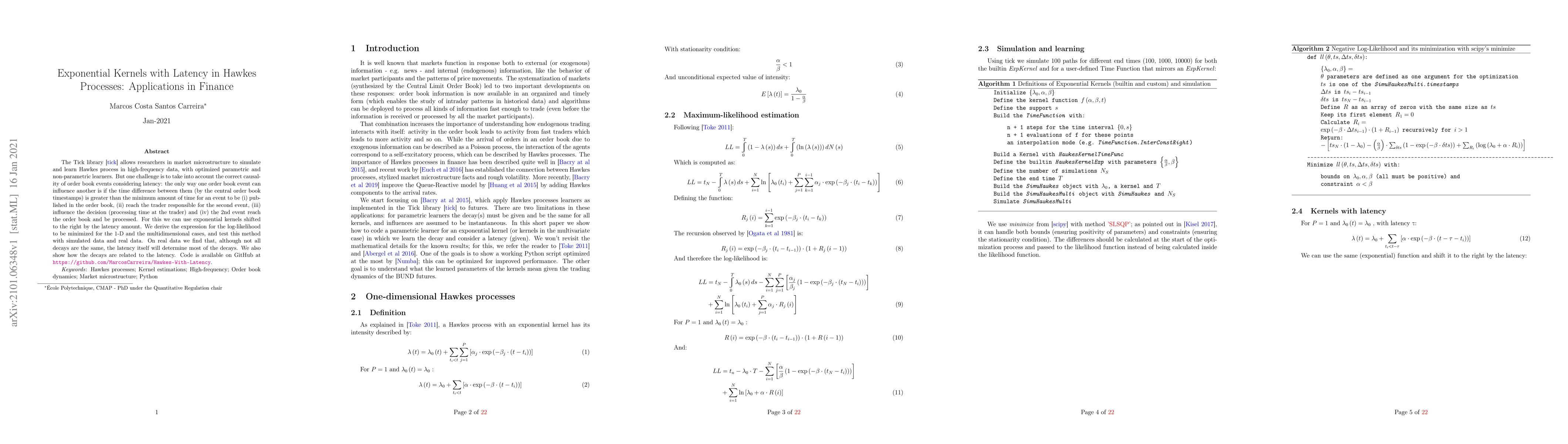

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModelling High-Frequency Data with Bivariate Hawkes Processes: Power-Law vs. Exponential Kernels

Neal Batra

FaDIn: Fast Discretized Inference for Hawkes Processes with General Parametric Kernels

Alexandre Gramfort, Thomas Moreau, Guillaume Staerman et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)