Summary

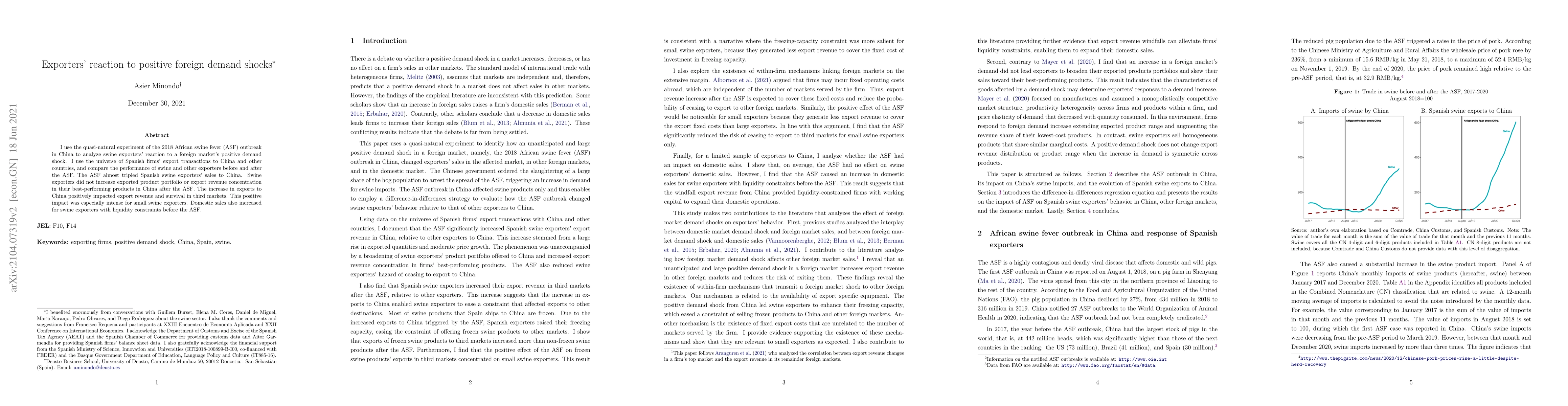

I use the quasi-natural experiment of the 2018 African swine fever (ASF) outbreak in China to analyze swine exporters' reaction to a foreign market's positive demand shock. I use the universe of Spanish firms' export transactions to China and other countries, and compare the performance of swine and other exporters before and after the ASF. The ASF almost tripled Spanish swine exporters' sales to China. Swine exporters did not increase exported product portfolio or export revenue concentration in their best-performing products in China after the ASF. The increase in exports to China positively impacted export revenue and survival in third markets. This positive impact was especially intense for small swine exporters. Domestic sales also increased for swine exporters with liquidity constraints before the ASF.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGender-Segmented Labor Markets and Foreign Demand Shocks

Carlos Góes, Gladys Lopez-Acevedo, Raymond Robertson

Inventories, Demand Shocks Propagation and Amplification in Supply Chains

Alessandro Ferrari

| Title | Authors | Year | Actions |

|---|

Comments (0)