Authors

Summary

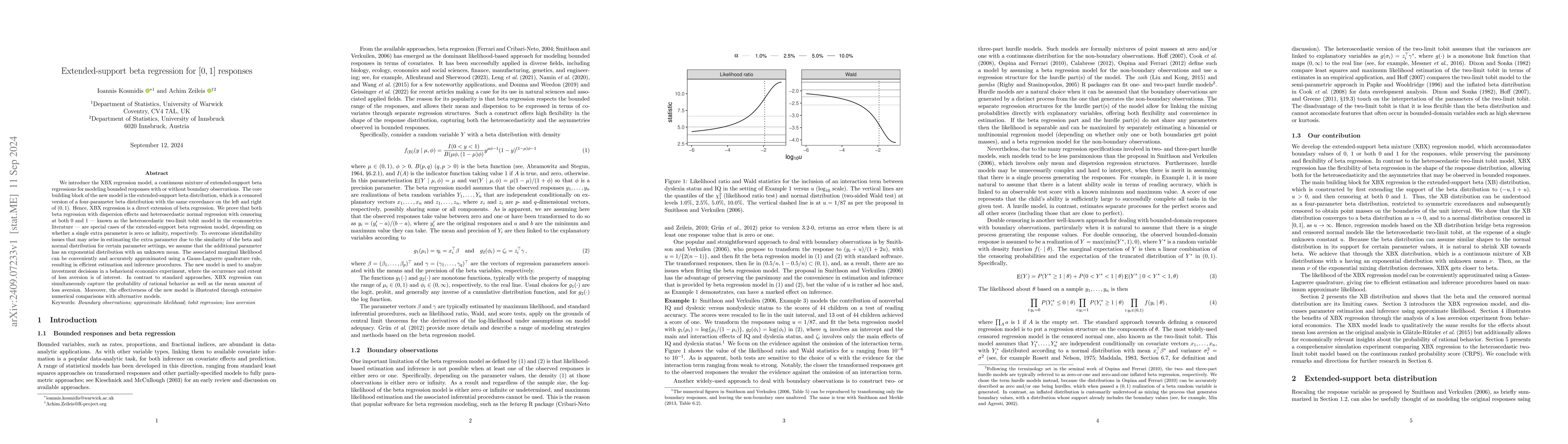

We introduce the XBX regression model, a continuous mixture of extended-support beta regressions for modeling bounded responses with or without boundary observations. The core building block of the new model is the extended-support beta distribution, which is a censored version of a four-parameter beta distribution with the same exceedance on the left and right of $(0, 1)$. Hence, XBX regression is a direct extension of beta regression. We prove that both beta regression with dispersion effects and heteroscedastic normal regression with censoring at both $0$ and $1$ -- known as the heteroscedastic two-limit tobit model in the econometrics literature -- are special cases of the extended-support beta regression model, depending on whether a single extra parameter is zero or infinity, respectively. To overcome identifiability issues that may arise in estimating the extra parameter due to the similarity of the beta and normal distribution for certain parameter settings, we assume that the additional parameter has an exponential distribution with an unknown mean. The associated marginal likelihood can be conveniently and accurately approximated using a Gauss-Laguerre quadrature rule, resulting in efficient estimation and inference procedures. The new model is used to analyze investment decisions in a behavioral economics experiment, where the occurrence and extent of loss aversion is of interest. In contrast to standard approaches, XBX regression can simultaneously capture the probability of rational behavior as well as the mean amount of loss aversion. Moreover, the effectiveness of the new model is illustrated through extensive numerical comparisons with alternative models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersScale-Location-Truncated Beta Regression: Expanding Beta Regression to Accommodate 0 and 1

Mingang Kim, Mikhail N. Koffarnus, Christopher T. Franck et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)