Summary

We examine how textual features in earnings press releases predict stock returns on earnings announcement days. Using over 138,000 press releases from 2005 to 2023, we compare traditional bag-of-words and BERT-based embeddings. We find that press release content (soft information) is as informative as earnings surprise (hard information), with FinBERT yielding the highest predictive power. Combining models enhances explanatory strength and interpretability of the content of press releases. Stock prices fully reflect the content of press releases at market open. If press releases are leaked, it offers predictive advantage. Topic analysis reveals self-serving bias in managerial narratives. Our framework supports real-time return prediction through the integration of online learning, provides interpretability and reveals the nuanced role of language in price formation.

AI Key Findings

Generated Sep 30, 2025

Methodology

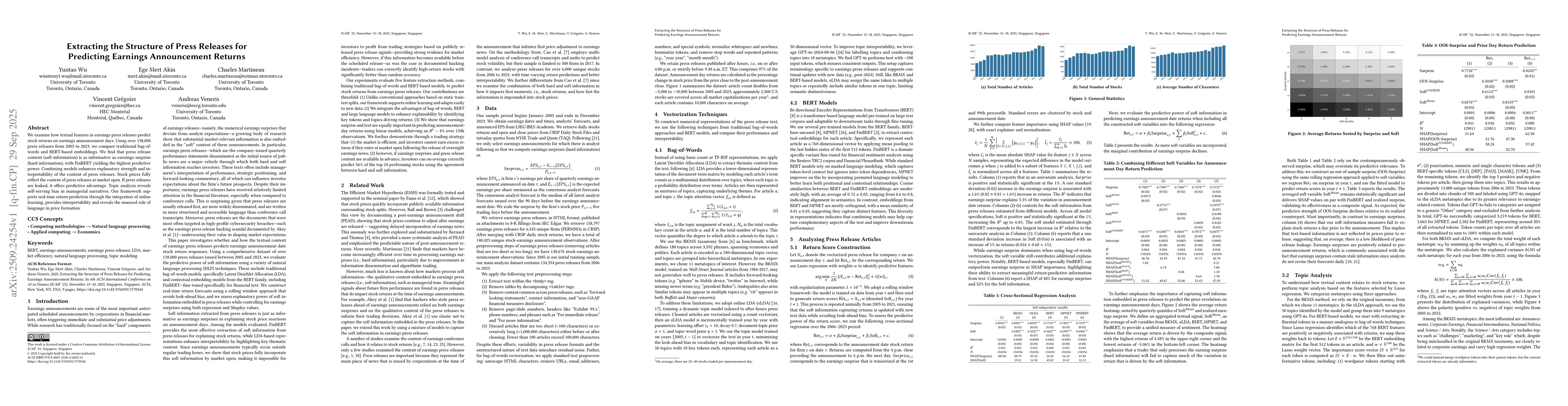

The research combines multiple models including FinBERT, oLDA, and MPNet to analyze earnings press releases and predict announcement day returns. It integrates both hard information (earning surprises) and soft information (textual content) from press releases, using SHAP values and precision metrics to evaluate model performance.

Key Results

- Both earning surprises and press release text explain a similar share of return variation.

- FinBERT achieves the highest SHAP values and R-squared, but traditional bag-of-words models like oLDA improve prediction accuracy and offer greater explainability.

- Combining hard and soft information significantly enhances the ability to identify top-performing stocks, with precision increasing from 0.36 to 0.52 for top 10 stocks.

Significance

This research highlights the critical role of both quantitative earnings data and qualitative press release content in financial markets. It provides actionable insights for investors and regulators by demonstrating how information leakage can impact market efficiency and fairness.

Technical Contribution

The paper introduces a hybrid model combining FinBERT with traditional text analysis techniques, demonstrating how different NLP approaches can complement each other in financial text analysis.

Novelty

This work is novel in its comprehensive integration of both hard financial metrics and soft textual information from press releases, along with its empirical validation of how information leakage affects market outcomes.

Limitations

- The study focuses on historical data and may not fully capture real-time market dynamics.

- The analysis assumes perfect information dissemination, which may not reflect actual market conditions.

Future Work

- Integrate conference call text and audio to explore deeper information flow.

- Investigate the impact of information leakage on market efficiency using real-time data.

- Develop more robust cybersecurity frameworks for financial information systems.

Comments (0)