Authors

Summary

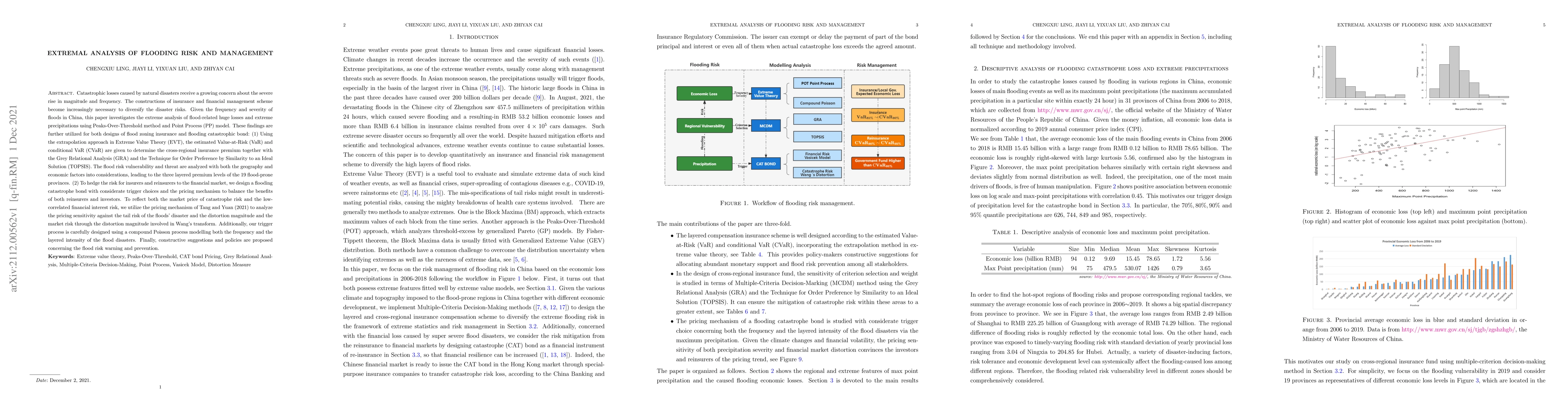

Catastrophic losses caused by natural disasters receive a growing concern about the severe rise in magnitude and frequency. The constructions of insurance and financial management scheme become increasingly necessary to diversify the disaster risks. Given the frequency and severity of floods in China, this paper investigates the extreme analysis of flood-related huge losses and extreme precipitations using Peaks-Over-Threshold method and Point Process (PP) model. These findings are further utilized for both designs of flood zoning insurance and flooding catastrophic bond: (1) Using the extrapolation approach in Extreme Value Theory (EVT), the estimated Value-at-Risk (VaR) and conditional VaR (CVaR) are given to determine the cross-regional insurance premium together with the Grey Relational Analysis (GRA) and the Technique for Order Preference by Similarity to an Ideal Solution (TOPSIS). The flood risk vulnerability and threat are analyzed with both the geography and economic factors into considerations, leading to the three layered premium levels of the 19 flood-prone provinces. (2) To hedge the risk for insurers and reinsurers to the financial market, we design a flooding catastrophe bond with considerate trigger choices and the pricing mechanism to balance the benefits of both reinsurers and investors. To reflect both the market price of catastrophe risk and the low-correlated financial interest risk, we utilize the pricing mechanism of Tang and Yuan (2021) to analyze the pricing sensitivity against the tail risk of the flooding disaster and the distortion magnitude and the market risk through the distortion magnitude involved in Wang's transform. Finally, constructive suggestions and policies are proposed concerning the flood risk warning and prevention.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSystemic Risk Management via Maximum Independent Set in Extremal Dependence Networks

Tiandong Wang, Qian Hui

No citations found for this paper.

Comments (0)