Summary

This article proposes a generalized notion of extreme multivariate dependence between two random vectors which relies on the extremality of the cross-covariance matrix between these two vectors. Using a partial ordering on the cross-covariance matrices, we also generalize the notion of positive upper dependence. We then proposes a means to quantify the strength of the dependence between two given multivariate series and to increase this strength while preserving the marginal distributions. This allows for the design of stress-tests of the dependence between two sets of financial variables, that can be useful in portfolio management or derivatives pricing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

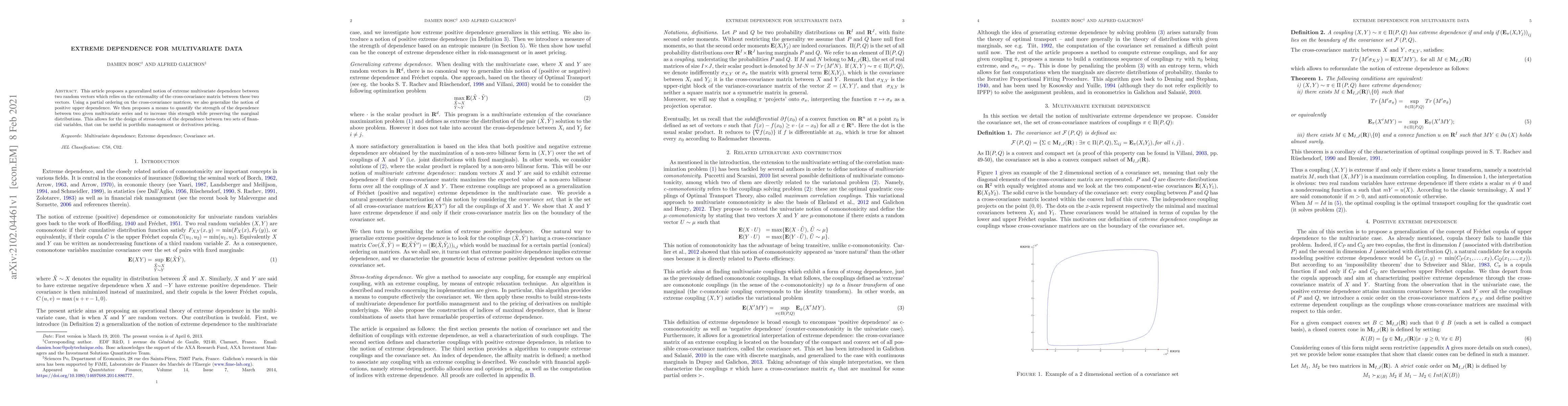

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultivariate extreme values for dynamical systems

Romain Aimino, Ana Cristina Moreira Freitas, Jorge Milhazes Freitas et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)