Authors

Summary

Dynamic spectral risk measures define a claim's valuation bounds as supremum and infimum of expectations of the claim's payoff over a dominated set of measures. The measures at which such extrema are attained are called extreme measures. We determine explicit expressions for their Radon-Nykodim derivatives with respect to the common dominating measure. Based on the formulas found, we estimate the extreme measures in two cases. First, the dominating measure is calibrated to mid prices of options and valuation bounds are given by options bid and ask prices. Second, the dominating measure is estimated from historical mid equity prices and valuation bounds are given by historical 5-day high and low prices. In both experiments, we find that the market determines upper bounds by testing scenarios in which losses are significantly lower than expected under the dominating measure, while lower bounds by ones in which gains are only slightly lower than in the base case.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

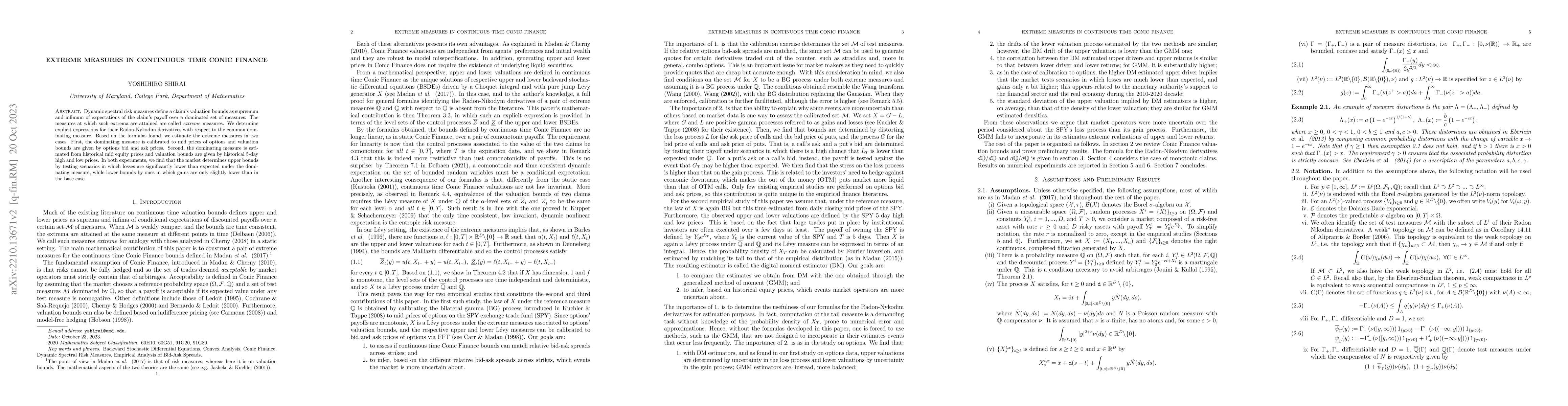

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExtreme Continuous Treatment Effects: Measures, Estimation and Inference

Wei Huang, Shuo Li, Liuhua Peng

No citations found for this paper.

Comments (0)