Authors

Summary

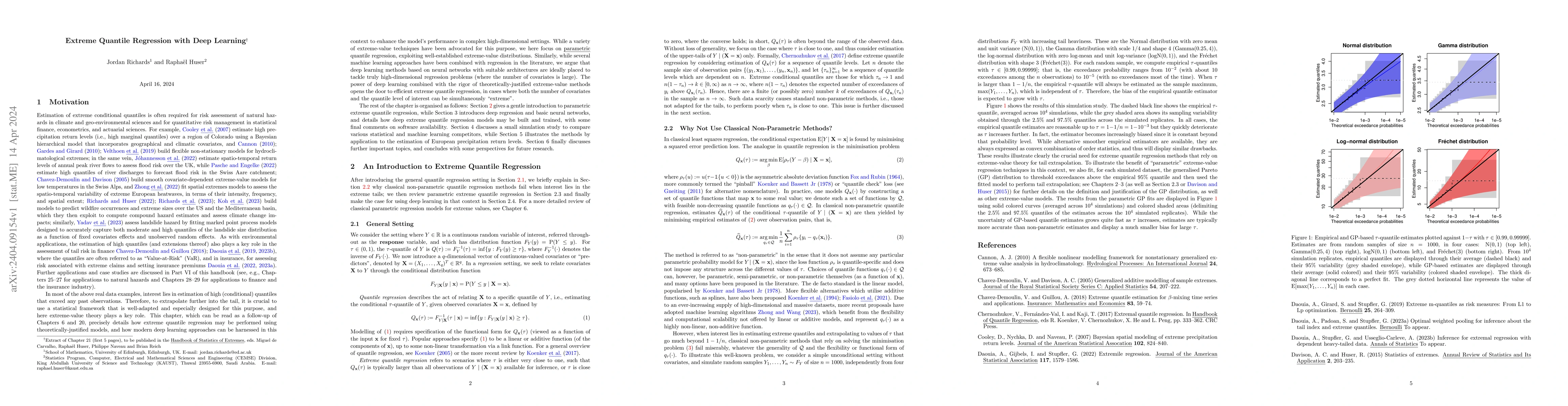

Estimation of extreme conditional quantiles is often required for risk assessment of natural hazards in climate and geo-environmental sciences and for quantitative risk management in statistical finance, econometrics, and actuarial sciences. Interest often lies in extrapolating to quantile levels that exceed any past observations. Therefore, it is crucial to use a statistical framework that is well-adapted and especially designed for this purpose, and here extreme-value theory plays a key role. This chapter reviews how extreme quantile regression may be performed using theoretically-justified models, and how modern deep learning approaches can be harnessed in this context to enhance the model's performance in complex high-dimensional settings. The power of deep learning combined with the rigor of theoretically-justified extreme-value methods opens the door to efficient extreme quantile regression, in cases where both the number of covariates and the quantile level of interest can be simultaneously ``extreme''.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGradient boosting for extreme quantile regression

Clément Dombry, Sebastian Engelke, Jasper Velthoen et al.

Deep Huber quantile regression networks

Georgia Papacharalampous, Hristos Tyralis, Nilay Dogulu et al.

No citations found for this paper.

Comments (0)