Summary

The continuous growth of the e-commerce industry attracts fraudsters who exploit stolen credit card details. Companies often investigate suspicious transactions in order to retain customer trust and address gaps in their fraud detection systems. However, analysts are overwhelmed with an enormous number of alerts from credit card transaction monitoring systems. Each alert investigation requires from the fraud analysts careful attention, specialized knowledge, and precise documentation of the outcomes, leading to alert fatigue. To address this, we propose a fraud analyst assistant (FAA) framework, which employs multi-modal large language models (LLMs) to automate credit card fraud investigations and generate explanatory reports. The FAA framework leverages the reasoning, code execution, and vision capabilities of LLMs to conduct planning, evidence collection, and analysis in each investigation step. A comprehensive empirical evaluation of 500 credit card fraud investigations demonstrates that the FAA framework produces reliable and efficient investigations comprising seven steps on average. Thus we found that the FAA framework can automate large parts of the workload and help reduce the challenges faced by fraud analysts.

AI Key Findings

Generated Sep 02, 2025

Methodology

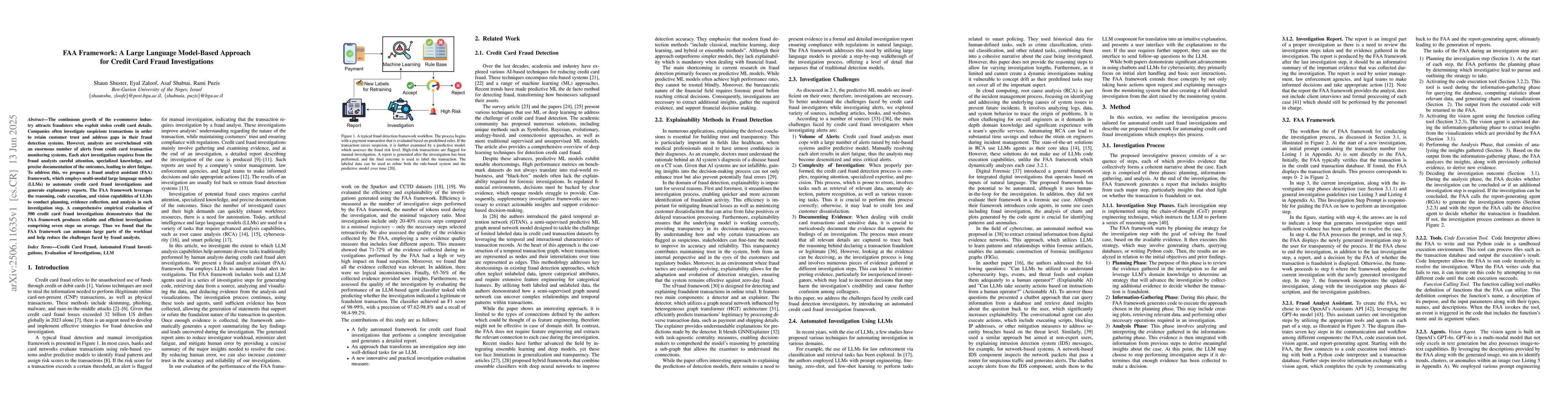

The research proposes a Fraud Analyst Assistant (FAA) framework that uses large language models (LLMs) to automate credit card fraud investigations, handling steps such as planning, evidence collection, and analysis. The FAA framework includes components like the Report-Generating Agent (RGA) and the Detective Agent to produce detailed reports and determine fraudulence.

Key Results

- The FAA framework successfully automated large parts of the fraud investigation workload, reducing challenges for fraud analysts.

- A comprehensive evaluation of 500 credit card fraud investigations demonstrated the reliability and efficiency of the FAA framework, averaging seven investigation steps.

- The FAA framework outperformed baseline methods on the Sparkov dataset, achieving an F1 score of 0.9801, and showed competitive performance on the CCTD dataset with an F1 score of 0.99.

- The inclusion of the Vision Agent in the FAA framework improved the minimal trajectory ratio, indicating more efficient paths, although it increased token usage significantly.

- The evidence generated by the FAA framework was found to be reliable for determining transaction fraudulence, although the framework might be more expensive compared to other detection models.

Significance

This research is significant as it addresses the challenges of high volumes of alerts, investigation complexity, and evidence documentation in credit card fraud investigations by leveraging the power of LLMs, enhancing efficiency, accuracy, and transparency in the process.

Technical Contribution

The FAA framework integrates planning, information-gathering, and analysis phases to dynamically investigate suspicious transactions, automating critical steps and providing detailed, structured reports to enhance analyst decision-making.

Novelty

The FAA framework stands out by systematically addressing core challenges in credit card fraud investigations using LLMs, which differentiate it from existing methods by offering automation, structured reporting, and improved efficiency.

Limitations

- The evaluation was limited to 500 transactions due to budget constraints on OpenAI's Assistant API usage.

- The framework does not account for continuous learning to adapt to emerging fraud patterns, as it does not learn from new investigations.

Future Work

- Investigating the impact of continuous learning on the performance of the FAA framework.

- Exploring ways to reduce computational resource expenditures while maintaining efficiency gains from the Vision Agent.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

Credit Card Fraud Detection with Subspace Learning-based One-Class Classification

Moncef Gabbouj, Fahad Sohrab, Juho Kanniainen et al.

No citations found for this paper.

Comments (0)