Authors

Summary

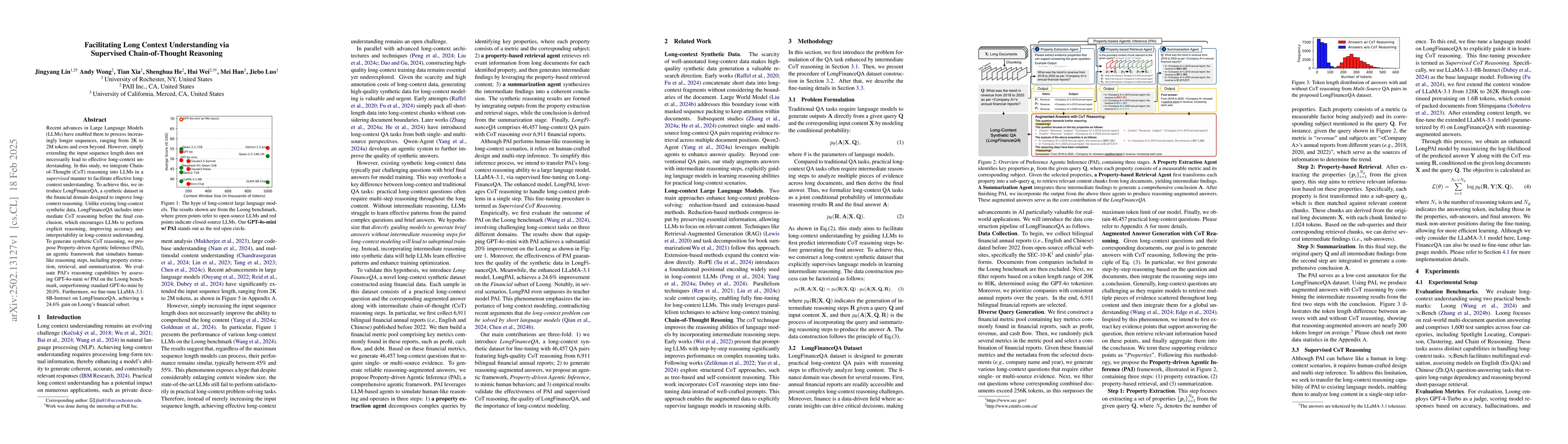

Recent advances in Large Language Models (LLMs) have enabled them to process increasingly longer sequences, ranging from 2K to 2M tokens and even beyond. However, simply extending the input sequence length does not necessarily lead to effective long-context understanding. In this study, we integrate Chain-of-Thought (CoT) reasoning into LLMs in a supervised manner to facilitate effective long-context understanding. To achieve this, we introduce LongFinanceQA, a synthetic dataset in the financial domain designed to improve long-context reasoning. Unlike existing long-context synthetic data, LongFinanceQA includes intermediate CoT reasoning before the final conclusion, which encourages LLMs to perform explicit reasoning, improving accuracy and interpretability in long-context understanding. To generate synthetic CoT reasoning, we propose Property-driven Agentic Inference (PAI), an agentic framework that simulates human-like reasoning steps, including property extraction, retrieval, and summarization. We evaluate PAI's reasoning capabilities by assessing GPT-4o-mini w/ PAI on the Loong benchmark, outperforming standard GPT-4o-mini by 20.0%. Furthermore, we fine-tune LLaMA-3.1-8B-Instruct on LongFinanceQA, achieving a 24.6% gain on Loong's financial subset.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research introduces LongFinanceQA, a synthetic dataset for long-context financial reasoning, and develops Property-driven Agentic Inference (PAI) for generating reasoning-augmented answers. It fine-tunes LLaMA-3.1-8B-Instruct on LongFinanceQA, outperforming the base model by 24.6% on the Loong financial subset.

Key Results

- LongPAI outperforms the base LLaMA-3.1-8B-Instruct model by 24.6% on the Loong financial subset.

- PAI significantly improves GPT-4o-mini's performance on the Loong benchmark by 20.3%.

- LongPAI surpasses state-of-the-art closed-source models like Geneni-1.5-pro by over 15%.

- LongPAI achieves competitive performance against existing state-of-the-art language models on the ∞Bench.

- LongPAI is comparable to its teacher model, GPT-4o-mini w/ PAI, and even surpasses it in some cases.

Significance

This research highlights the importance of long-context modeling, challenging the claim that short language models can adequately address long-context problems. It demonstrates that certain long-context problems require long-context modeling, as short models struggle with analyzing and reasoning over reduced or retrieved information.

Technical Contribution

The introduction of LongFinanceQA, a synthetic financial dataset, and the development of the Property-driven Agentic Inference (PAI) framework for generating reasoning-augmented answers.

Novelty

The research distinguishes itself by integrating Chain-of-Thought (CoT) reasoning into LLMs in a supervised manner using LongFinanceQA, which includes intermediate CoT reasoning before the final conclusion, improving accuracy and interpretability in long-context understanding.

Limitations

- The effectiveness of supervised CoT reasoning for long-context modeling in broader scenarios remains uncertain.

- PAI still relies on human-crafted prompts to guide agents in maintaining structured reasoning.

Future Work

- Explore the impact of diverse data sources and different data scales to address the uncertainty of LongPAI's generalizability.

- Investigate inference methods that enable autonomous reasoning with long-context inputs, minimizing reliance on extensive human-crafted prompts.

Paper Details

PDF Preview

Similar Papers

Found 4 papersChain-of-Thought Matters: Improving Long-Context Language Models with Reasoning Path Supervision

Sujian Li, Xun Wang, Dawei Zhu et al.

Recall with Reasoning: Chain-of-Thought Distillation for Mamba's Long-Context Memory and Extrapolation

Tianqing Fang, Hongming Zhang, Dong Yu et al.

Ego-R1: Chain-of-Tool-Thought for Ultra-Long Egocentric Video Reasoning

Hao Zhang, Ruiqi Wang, Ziwei Liu et al.

Long-Short Chain-of-Thought Mixture Supervised Fine-Tuning Eliciting Efficient Reasoning in Large Language Models

Kai Chen, Bin Yu, Hang Yuan et al.

No citations found for this paper.

Comments (0)