Summary

Deep Reinforcement learning is a branch of unsupervised learning in which an agent learns to act based on environment state in order to maximize its total reward. Deep reinforcement learning provides good opportunity to model the complexity of portfolio choice in high-dimensional and data-driven environment by leveraging the powerful representation of deep neural networks. In this paper, we build a portfolio management system using direct deep reinforcement learning to make optimal portfolio choice periodically among S\&P500 underlying stocks by learning a good factor representation (as input). The result shows that an effective learning of market conditions and optimal portfolio allocations can significantly outperform the average market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

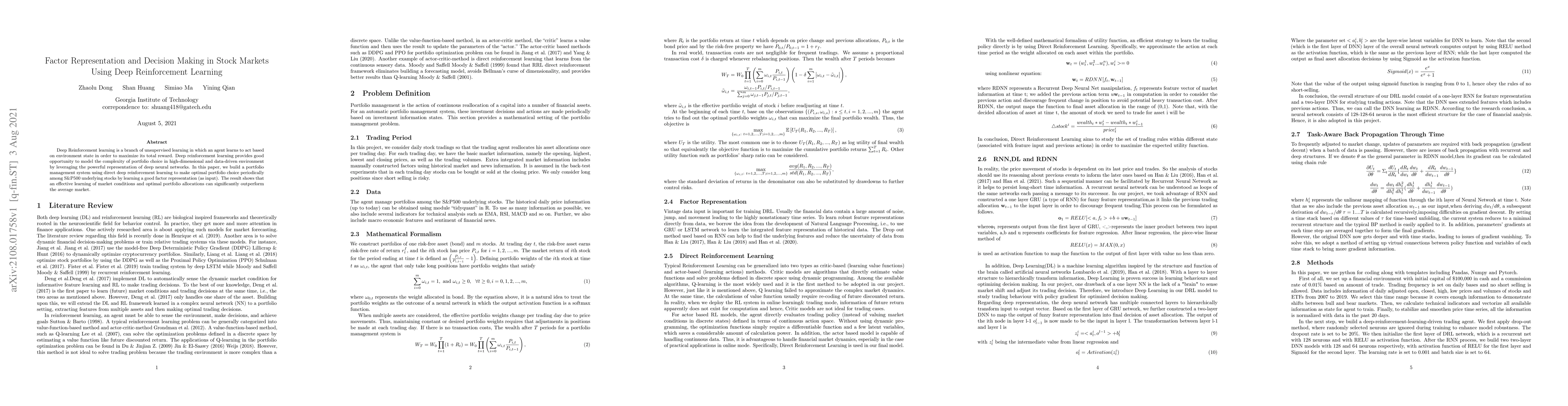

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning Approach for Trading Automation in The Stock Market

Ekrem Duman, Taylan Kabbani

Decision Making in Monopoly using a Hybrid Deep Reinforcement Learning Approach

Mayank Kejriwal, Vaneet Aggarwal, Hongyu Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)