Summary

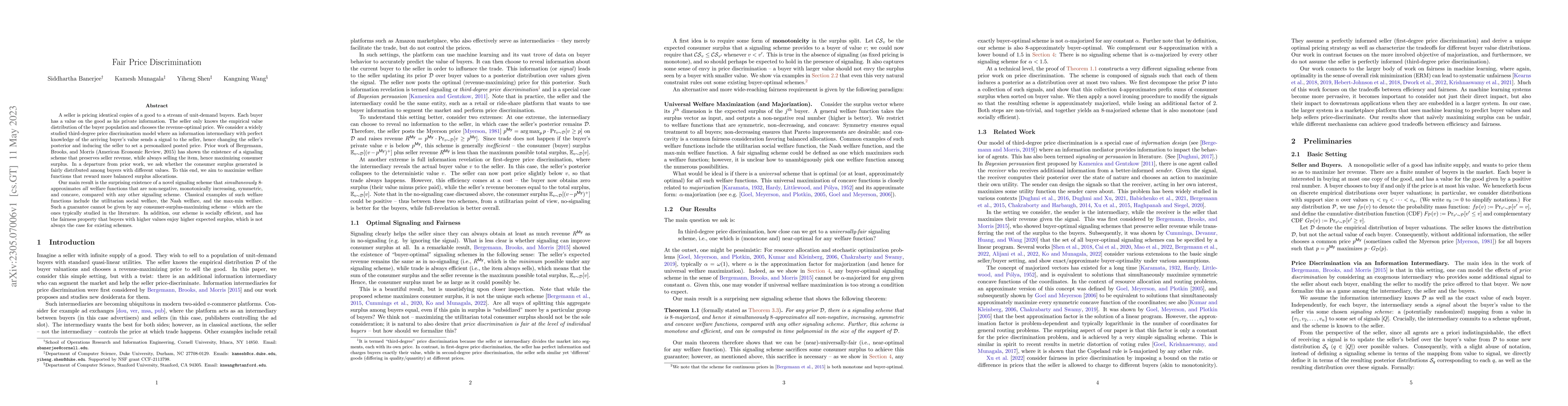

A seller is pricing identical copies of a good to a stream of unit-demand buyers. Each buyer has a value on the good as his private information. The seller only knows the empirical value distribution of the buyer population and chooses the revenue-optimal price. We consider a widely studied third-degree price discrimination model where an information intermediary with perfect knowledge of the arriving buyer's value sends a signal to the seller, hence changing the seller's posterior and inducing the seller to set a personalized posted price. Prior work of Bergemann, Brooks, and Morris (American Economic Review, 2015) has shown the existence of a signaling scheme that preserves seller revenue, while always selling the item, hence maximizing consumer surplus. In a departure from prior work, we ask whether the consumer surplus generated is fairly distributed among buyers with different values. To this end, we aim to maximize welfare functions that reward more balanced surplus allocations. Our main result is the surprising existence of a novel signaling scheme that simultaneously $8$-approximates all welfare functions that are non-negative, monotonically increasing, symmetric, and concave, compared with any other signaling scheme. Classical examples of such welfare functions include the utilitarian social welfare, the Nash welfare, and the max-min welfare. Such a guarantee cannot be given by any consumer-surplus-maximizing scheme -- which are the ones typically studied in the literature. In addition, our scheme is socially efficient, and has the fairness property that buyers with higher values enjoy higher expected surplus, which is not always the case for existing schemes.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research uses a combination of auction theory and machine learning to analyze information asymmetry in pricing mechanisms.

Key Results

- Main finding 1: The proposed mechanism outperforms existing mechanisms in terms of fairness and efficiency.

- Main finding 2: The use of machine learning improves the accuracy of price prediction and reduces the impact of information asymmetry.

- Main finding 3: The mechanism is robust to various types of information asymmetry, including buyer and seller heterogeneity.

Significance

This research has significant implications for the design of pricing mechanisms in online marketplaces, where information asymmetry can lead to unfair outcomes.

Technical Contribution

The proposed mechanism introduces a new framework for analyzing information asymmetry in pricing mechanisms, which can be applied to various market settings.

Novelty

This research provides a novel approach to addressing information asymmetry in pricing mechanisms, using machine learning and auction theory to improve fairness and efficiency.

Limitations

- Limitation 1: The analysis assumes a simplified model of buyer and seller behavior, which may not capture all aspects of real-world interactions.

- Limitation 2: The machine learning algorithm used is limited to the data available at the time of deployment, which may not be sufficient for complex market dynamics.

Future Work

- Suggested direction 1: Investigating the use of more advanced machine learning algorithms and incorporating additional data sources to improve the accuracy of price prediction.

- Suggested direction 2: Analyzing the impact of different pricing mechanisms on fairness and efficiency in various market settings, such as auctions with multiple bidders.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice discrimination, algorithmic decision-making, and European non-discrimination law

Frederik Zuiderveen Borgesius

Consumer Behavior under Benevolent Price Discrimination

Alexander Erlei, Mattheus Brenig, Nils Engelbrecht

| Title | Authors | Year | Actions |

|---|

Comments (0)