Authors

Summary

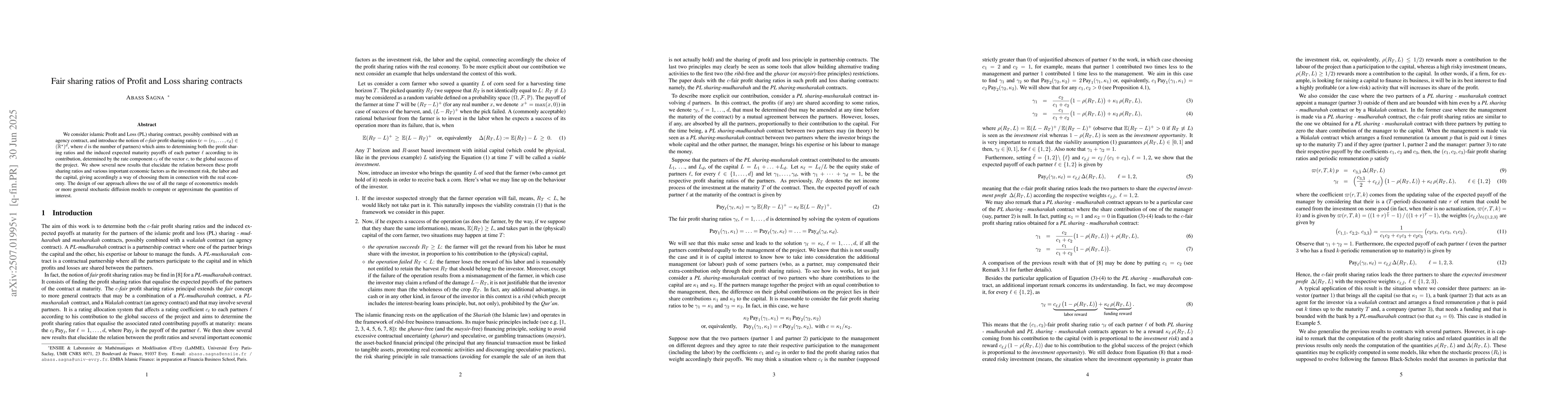

We consider islamic Profit and Loss (PL) sharing contract, possibly combined with an agency contract, and introduce the notion of {\em $c$-fair} profit sharing ratios ($c = (c_1, \ldots,c_d) \in (\mathbb R^{\star})^d$, where $d$ is the number of partners) which aims to determining both the profit sharing ratios and the induced expected maturity payoffs of each partner $\ell$ according to its contribution, determined by the rate component $c_{\ell}$ of the vector $c$, to the global success of the project. We show several new results that elucidate the relation between these profit sharing ratios and various important economic factors as the investment risk, the labor and the capital, giving accordingly a way of choosing them in connection with the real economy. The design of our approach allows the use of all the range of econometrics models or more general stochastic diffusion models to compute or approximate the quantities of interest.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)