Summary

Hamza-Klebaner posed the problem of constructing martingales with Brownian marginals that differ from Brownian motion, so called fake Brownian motions. Besides its theoretical appeal, the problem represents the quintessential version of the ubiquitous fitting problem in mathematical finance where the task is to construct martingales that satisfy marginal constraints imposed by market data. Non-continuous solutions to this challenge were given by Madan-Yor, Hamza-Klebaner, Hobson, and Fan-Hamza-Klebaner whereas continuous (but non-Markovian) fake Brownian motions were constructed by Oleszkiewicz, Albin, Baker-Donati-Yor, Hobson, Jourdain-Zhou. In contrast it is known from Gy\"ongy, Dupire, and ultimately Lowther that Brownian motion is the unique continuous strong Markov martingale with Brownian marginals. We took this as a challenge to construct examples of a "very fake'' Brownian motion, that is, continuous Markov martingales with Brownian marginals that miss out only on the strong Markov property.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

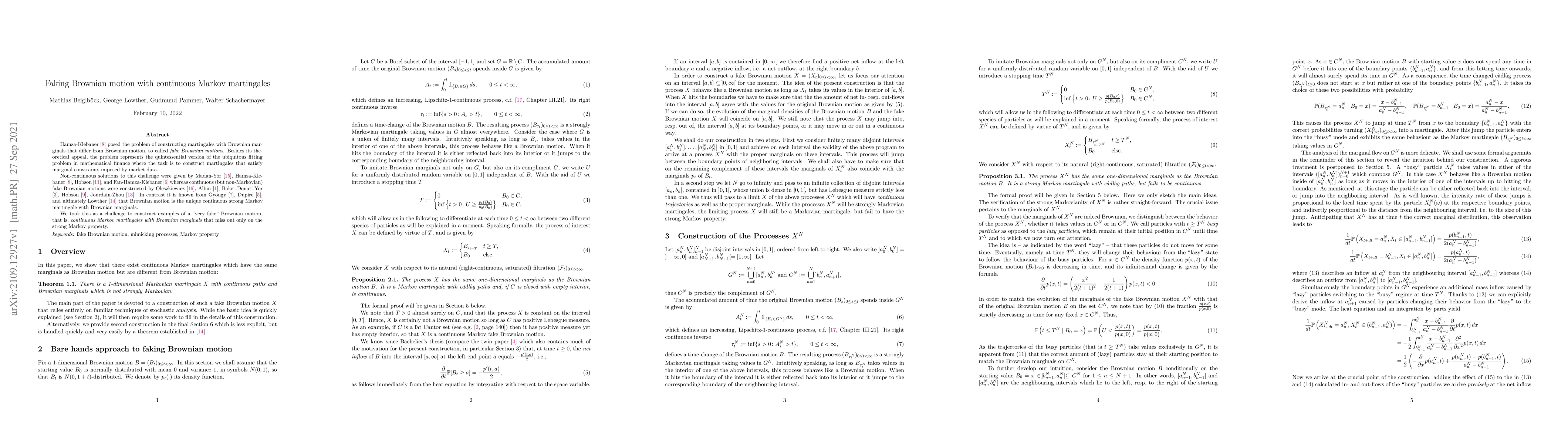

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)