Summary

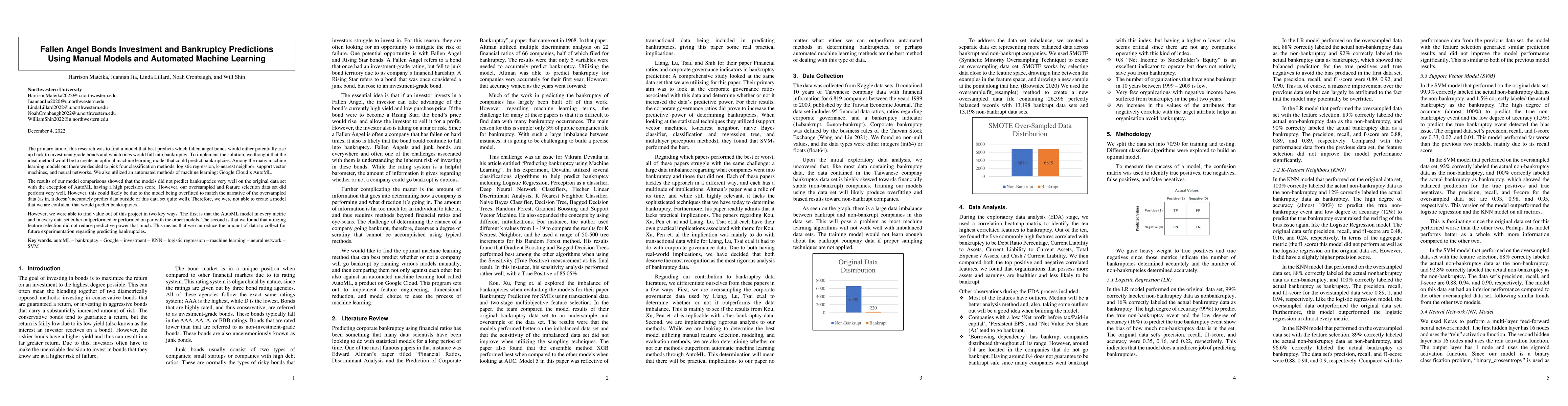

The primary aim of this research was to find a model that best predicts which fallen angel bonds would either potentially rise up back to investment grade bonds and which ones would fall into bankruptcy. To implement the solution, we thought that the ideal method would be to create an optimal machine learning model that could predict bankruptcies. Among the many machine learning models out there we decided to pick four classification methods: logistic regression, KNN, SVM, and NN. We also utilized an automated methods of Google Cloud's machine learning. The results of our model comparisons showed that the models did not predict bankruptcies very well on the original data set with the exception of Google Cloud's machine learning having a high precision score. However, our over-sampled and feature selection data set did perform very well. This could likely be due to the model being over-fitted to match the narrative of the over-sampled data (as in, it does not accurately predict data outside of this data set quite well). Therefore, we were not able to create a model that we are confident that would predict bankruptcies. However, we were able to find value out of this project in two key ways. The first is that Google Cloud's machine learning model in every metric and in every data set either outperformed or performed on par with the other models. The second is that we found that utilizing feature selection did not reduce predictive power that much. This means that we can reduce the amount of data to collect for future experimentation regarding predicting bankruptcies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDo forecasts of bankruptcy cause bankruptcy? A machine learning sensitivity analysis

P. Richard Hahn, Demetrios Papakostas, Jared Murray et al.

Automated Machine Learning for Remaining Useful Life Predictions

Marco F. Huber, Marius Lindauer, Marc-André Zöller et al.

Benchmarking Machine Learning Models to Predict Corporate Bankruptcy

Agam Shah, Sudheer Chava, Emmanuel Alanis

No citations found for this paper.

Comments (0)