Summary

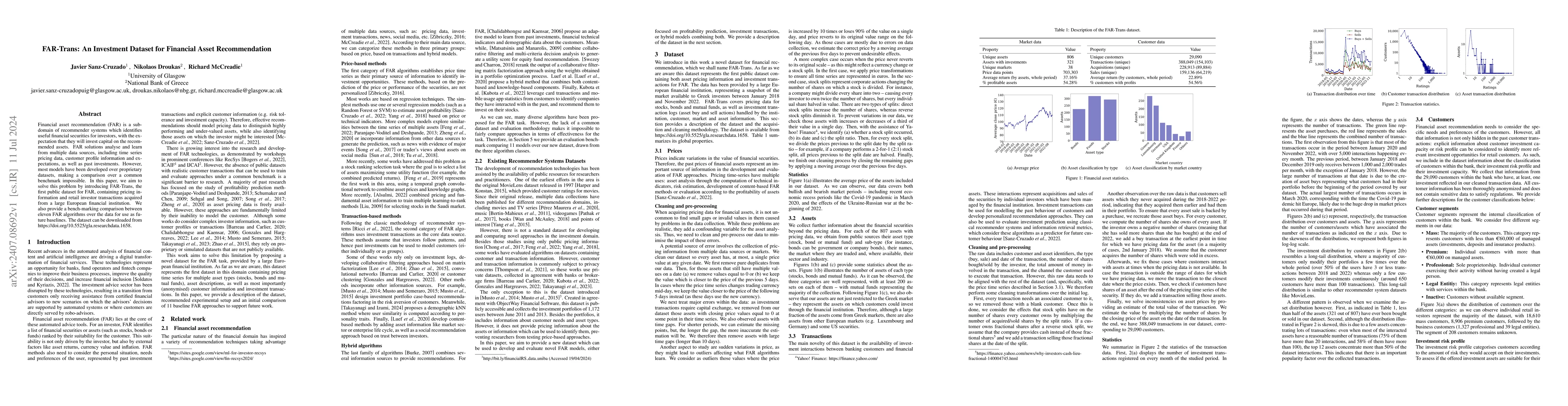

Financial asset recommendation (FAR) is a sub-domain of recommender systems which identifies useful financial securities for investors, with the expectation that they will invest capital on the recommended assets. FAR solutions analyse and learn from multiple data sources, including time series pricing data, customer profile information and expectations, as well as past investments. However, most models have been developed over proprietary datasets, making a comparison over a common benchmark impossible. In this paper, we aim to solve this problem by introducing FAR-Trans, the first public dataset for FAR, containing pricing information and retail investor transactions acquired from a large European financial institution. We also provide a bench-marking comparison between eleven FAR algorithms over the data for use as future baselines. The dataset can be downloaded from https://doi.org/10.5525/gla.researchdata.1658 .

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExposing Product Bias in LLM Investment Recommendation

Xiaoyu Zhang, Shiqing Ma, Chao Shen et al.

OpenSiteRec: An Open Dataset for Site Recommendation

Xiangyu Zhao, Yu Liu, Yong Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)