Authors

Summary

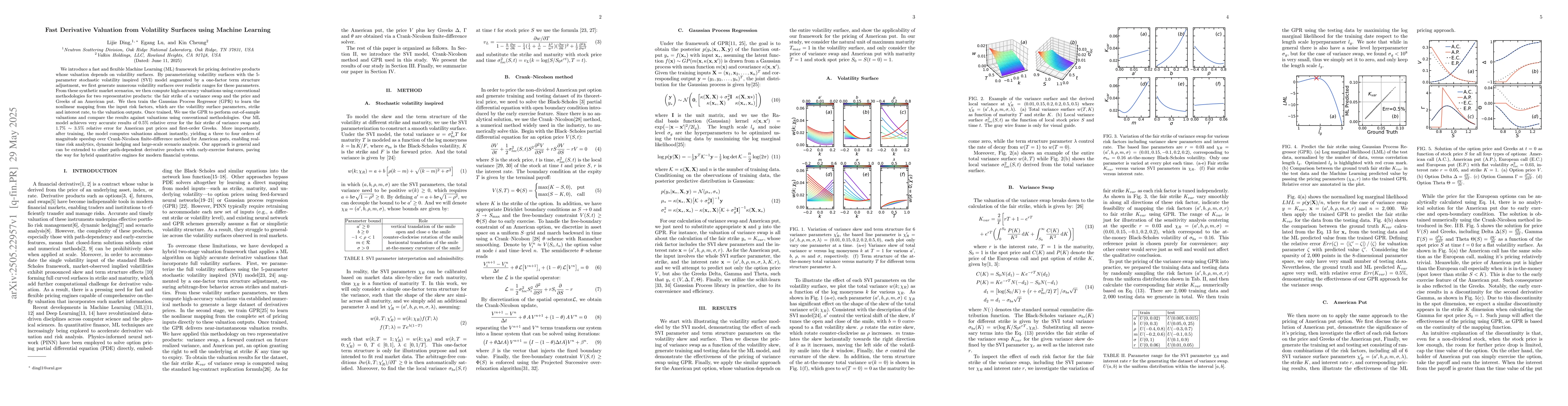

We introduce a fast and flexible Machine Learning (ML) framework for pricing derivative products whose valuation depends on volatility surfaces. By parameterizing volatility surfaces with the 5-parameter stochastic volatility inspired (SVI) model augmented by a one-factor term structure adjustment, we first generate numerous volatility surfaces over realistic ranges for these parameters. From these synthetic market scenarios, we then compute high-accuracy valuations using conventional methodologies for two representative products: the fair strike of a variance swap and the price and Greeks of an American put. We then train the Gaussian Process Regressor (GPR) to learn the nonlinear mapping from the input risk factors, which are the volatility surface parameters, strike and interest rate, to the valuation outputs. Once trained, We use the GPR to perform out-of-sample valuations and compare the results against valuations using conventional methodologies. Our ML model achieves very accurate results of $0.5\%$ relative error for the fair strike of variance swap and $1.7\% \sim 3.5\%$ relative error for American put prices and first-order Greeks. More importantly, after training, the model computes valuations almost instantly, yielding a three to four orders of magnitude speedup over Crank-Nicolson finite-difference method for American puts, enabling real-time risk analytics, dynamic hedging and large-scale scenario analysis. Our approach is general and can be extended to other path-dependent derivative products with early-exercise features, paving the way for hybrid quantitative engines for modern financial systems.

AI Key Findings

Generated Jun 05, 2025

Methodology

Introduced a Machine Learning (ML) framework using Gaussian Process Regressor (GPR) to price derivative products dependent on volatility surfaces. The volatility surfaces are parameterized using the 5-parameter SVI model plus a term structure adjustment. The GPR learns the nonlinear mapping from input risk factors to valuation outputs.

Key Results

- Achieved 0.5% relative error for fair strike of variance swap valuation.

- Obtained 1.7% to 3.5% relative error for American put prices and first-order Greeks.

- Provided three to four orders of magnitude speedup over Crank-Nicolson method for American puts.

Significance

The research offers a significant improvement in computational efficiency for pricing derivatives with early-exercise features, enabling real-time risk analytics, dynamic hedging, and large-scale scenario analysis.

Technical Contribution

Developed an ML framework that directly maps input risk factors to derivative valuations, reducing computational time significantly for products with early exercise features.

Novelty

The approach incorporates full volatility surface information and offers near-instantaneous valuation, unlike traditional numerical methods that require substantial computational resources and time.

Limitations

- The study was limited to two derivative products: variance swap fair strike and American put price and Greeks.

- The method's effectiveness may be affected by discontinuities in certain Greeks, particularly Gamma, due to early exercise features.

Future Work

- Explore alternative regression techniques to address challenges posed by valuation discontinuities.

- Enhance term-structure modeling by allowing all 5 SVI parameters to vary dynamically over time.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModelling and Forecasting Energy Market Volatility Using GARCH and Machine Learning Approach

Seulki Chung

EcoVal: An Efficient Data Valuation Framework for Machine Learning

Bowei Chen, Murari Mandal, Mohan Kankanhalli et al.

No citations found for this paper.

Comments (0)