Summary

The classic Fatou lemma states that the lower limit of a sequence of integrals of functions is greater or equal than the integral of the lower limit. It is known that Fatou's lemma for a sequence of weakly converging measures states a weaker inequality because the integral of the lower limit is replaced with the integral of the lower limit in two parameters, where the second parameter is the argument of the functions. This paper provides sufficient conditions when Fatou's lemma holds in its classic form for a sequence of weakly converging measures. The functions can take both positive and negative values. The paper also provides similar results for sequences of setwise converging measures. It also provides Lebesgue's and monotone convergence theorems for sequences of weakly and setwise converging measures. The obtained results are used to prove broad sufficient conditions for the validity of optimality equations for average-cost Markov decision processes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

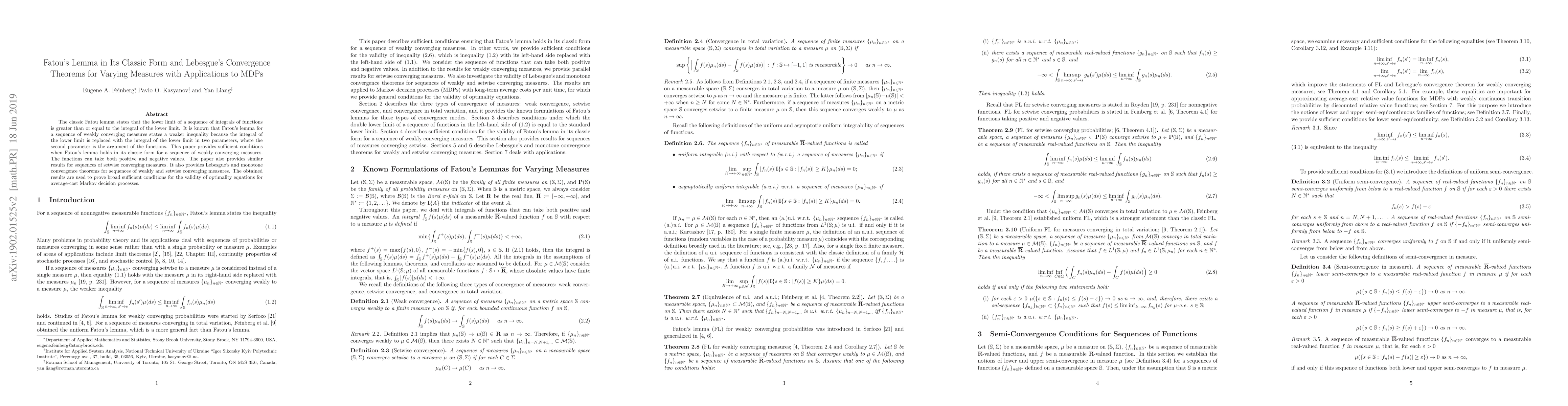

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEpi-Convergence of Expectation Functions under Varying Measures and Integrands

Johannes O. Royset, Eugene A. Feinberg, Pavlo O. Kasyanov

| Title | Authors | Year | Actions |

|---|

Comments (0)