Summary

Photovoltaic (PV) operators face substantial uncertainty in generation and short-term electricity prices. Continuous intraday markets enable producers to adjust their positions in real time, potentially improving revenues and reducing imbalance costs. We propose a feature-driven reinforcement learning (RL) approach for PV intraday trading that integrates data-driven features into the state and learns bidding policies in a sequential decision framework. The problem is cast as a Markov Decision Process with a reward that balances trading profit and imbalance penalties and is solved with Proximal Policy Optimization (PPO) using a predominantly linear, interpretable policy. Trained on historical market data and evaluated out-of-sample, the strategy consistently outperforms benchmark baselines across diverse scenarios. Extensive validation shows rapid convergence, real-time inference, and transparent decision rules. Learned weights highlight the central role of market microstructure and historical features. Taken together, these results indicate that feature-driven RL offers a practical, data-efficient, and operationally deployable pathway for active intraday participation by PV producers.

AI Key Findings

Generated Oct 29, 2025

Methodology

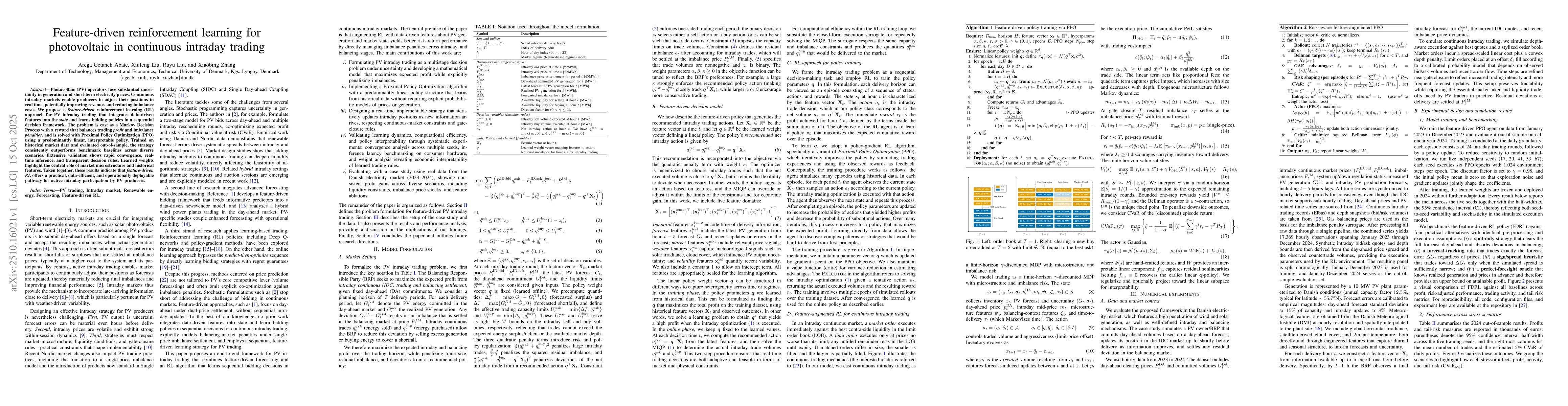

The research employs a feature-driven reinforcement learning approach to optimize intraday trading strategies for a photovoltaic power producer, leveraging real-time market data and domain-specific features.

Key Results

- The feature-driven policy consistently delivers significant uplift over spot-only trading across various market conditions.

- CVaR remains tightly clustered, indicating improvements are not obtained by loading additional tail risk.

- The policy achieves sub-millisecond inference latency, enabling real-time decision-making for hourly trading.

Significance

This research advances the integration of variable renewables into electricity markets by providing an adaptive trading strategy that reduces reliance on imperfect day-ahead forecasts and enhances operational efficiency.

Technical Contribution

The paper introduces a feature-driven reinforcement learning framework that directly learns from realized intraday profits and imbalance penalties using familiar hourly forecasts and price feeds, without requiring calibrated probabilistic models.

Novelty

The novelty lies in the combination of real-time market data with domain-specific features in a reinforcement learning framework, along with the interpretability of the linear policy weights that reveal economically sensible trading patterns.

Limitations

- A stylized execution layer calibrated to depth snapshots and spreads abstracts strategic order-book interactions and venue heterogeneity.

- The out-of-sample evaluation is limited to a single year (2024) after training on 2023 data.

- Hourly proxies are used for imbalance settlement.

Future Work

- Investigate portfolio-level control and aggregation across assets with explicit risk objectives (e.g., CVaR) in training.

- Develop richer execution models and conduct market-design analyses (gate-closure rules, liquidity incentives, imbalance pricing).

- Explore multi-agent settings to capture strategic BRP interactions and couple with physical models for system-level benefits.

Paper Details

PDF Preview

Similar Papers

Found 5 papersDeep reinforcement learning with positional context for intraday trading

Sven Goluža, Tomislav Kovačević, Tessa Bauman et al.

DeepScalper: A Risk-Aware Reinforcement Learning Framework to Capture Fleeting Intraday Trading Opportunities

Jian Li, Shuo Sun, Bo An et al.

Algorithmic Trading Using Continuous Action Space Deep Reinforcement Learning

Mahdi Shamsi, Farokh Marvasti, Naseh Majidi

Comments (0)