Authors

Summary

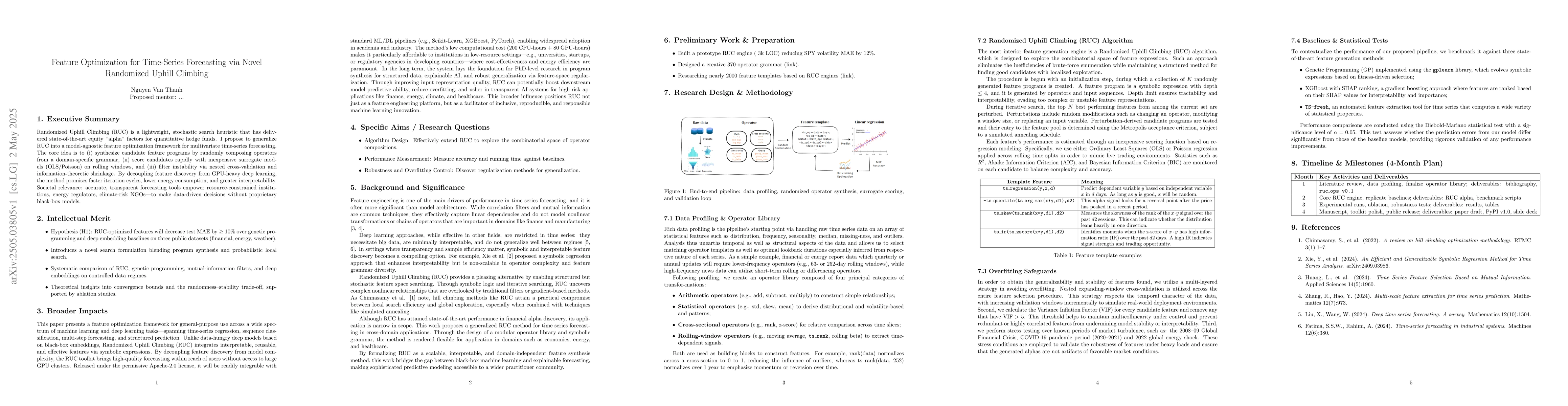

Randomized Uphill Climbing is a lightweight, stochastic search heuristic that has delivered state of the art equity alpha factors for quantitative hedge funds. I propose to generalize RUC into a model agnostic feature optimization framework for multivariate time series forecasting. The core idea is to synthesize candidate feature programs by randomly composing operators from a domain specific grammar, score candidates rapidly with inexpensive surrogate models on rolling windows, and filter instability via nested cross validation and information theoretic shrinkage. By decoupling feature discovery from GPU heavy deep learning, the method promises faster iteration cycles, lower energy consumption, and greater interpretability. Societal relevance: accurate, transparent forecasting tools empower resource constrained institutions, energy regulators, climate risk NGOs to make data driven decisions without proprietary black box models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExplainable Parallel RCNN with Novel Feature Representation for Time Series Forecasting

Jimeng Shi, Giri Narasimhan, Vitalii Stebliankin et al.

Forecasting large collections of time series: feature-based methods

Li Li, Feng Li, Yanfei Kang

FRANS: Automatic Feature Extraction for Time Series Forecasting

Alexey Chernikov, Christoph Bergmeir, Chang Wei Tan et al.

No citations found for this paper.

Comments (0)