Summary

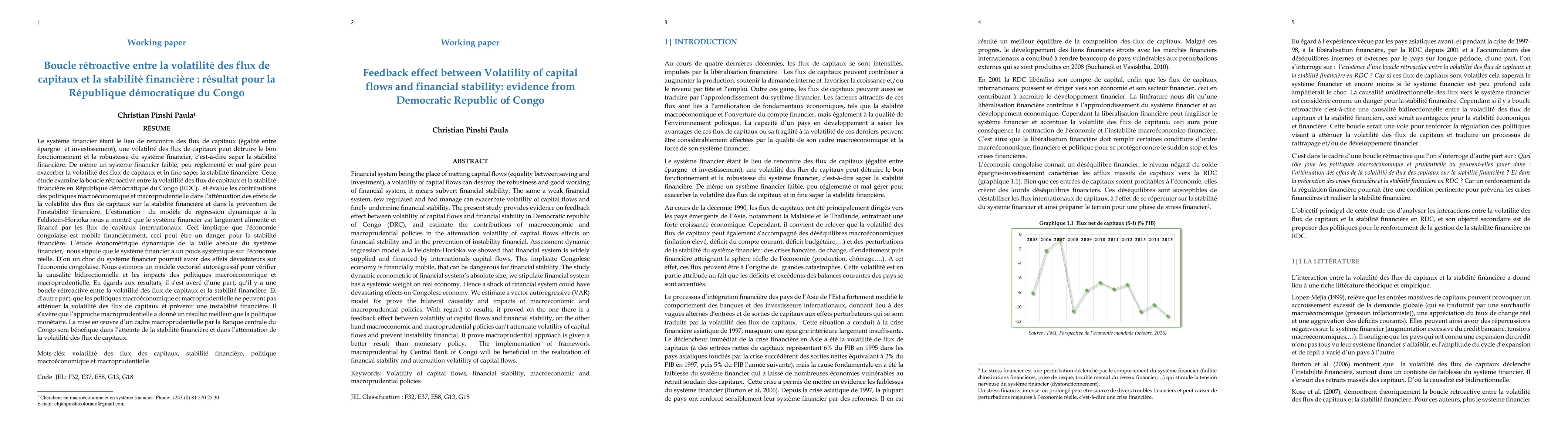

Financial system being the place of metting capital flows (equality between saving and investment), a volatility of capital flows can destroy the robustness and good working of financial system, it means subvert financial stability. The same a weak financial system, few regulated and bad manage can exacerbate volatility of capital flows and finely undermine financial stability. The present study provides evidence on feedback effect between volatility of capital flows and financial stability in Democratic republic of Congo (DRC), and estimate the contributions of macroeconomic and macroprudential policies in the attenuation volatility of capital flows effects on financial stability and in the prevention of instability financial. Assessment dynamic regression model a la Feldstein-Horioka we showed that financial system is widely supplied and financed by internationals capital flows. This implicate Congolese economy is financially mobile, that can be dangerous for financial stability. The study dynamic econometric of financial system's absolute size, we stipulate financial system has a systemic weight on real economy. Hence a shock of financial system could have devastating effects on Congolese economy. We estimate a vector autoregressive (VAR) model for prove the bilateral causality and impacts of macroeconomic and macroprudential policies. With regard to results, it proved on the one there is a feedback effect between volatility of capital flows and financial stability, on the other hand macroeconomic and macroprudential policies can't attenuate volatility of capital flows and prevent instability financial. It prove macroprudential approach is given a better result than monetary policy. The implementation of framework macroprudential by Central Bank of Congo will be beneficial in the realization of financial stability and attenuation volatility of capital flows.Keywords: Volatility of capital flows, financial stability, macroeconomic and macroprudential policies

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSafety of MVA-BN in Healthcare Personnel, Democratic Republic of the Congo

Yu, Y., Hughes, C., Kennedy, J. et al.

Ocular Manifestations in a Cohort of Patients with Mpox in the Democratic Republic of the Congo 2007 - 2011

J.-C., Liesenborghs, L., Linderman, S. et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)