Summary

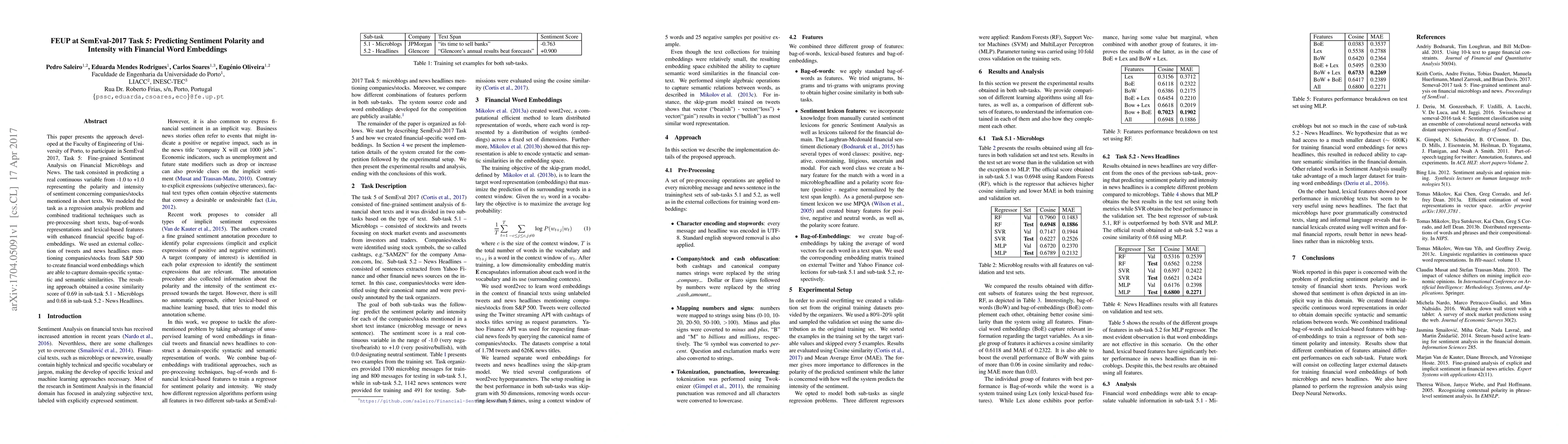

This paper presents the approach developed at the Faculty of Engineering of University of Porto, to participate in SemEval 2017, Task 5: Fine-grained Sentiment Analysis on Financial Microblogs and News. The task consisted in predicting a real continuous variable from -1.0 to +1.0 representing the polarity and intensity of sentiment concerning companies/stocks mentioned in short texts. We modeled the task as a regression analysis problem and combined traditional techniques such as pre-processing short texts, bag-of-words representations and lexical-based features with enhanced financial specific bag-of-embeddings. We used an external collection of tweets and news headlines mentioning companies/stocks from S\&P 500 to create financial word embeddings which are able to capture domain-specific syntactic and semantic similarities. The resulting approach obtained a cosine similarity score of 0.69 in sub-task 5.1 - Microblogs and 0.68 in sub-task 5.2 - News Headlines.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)