Summary

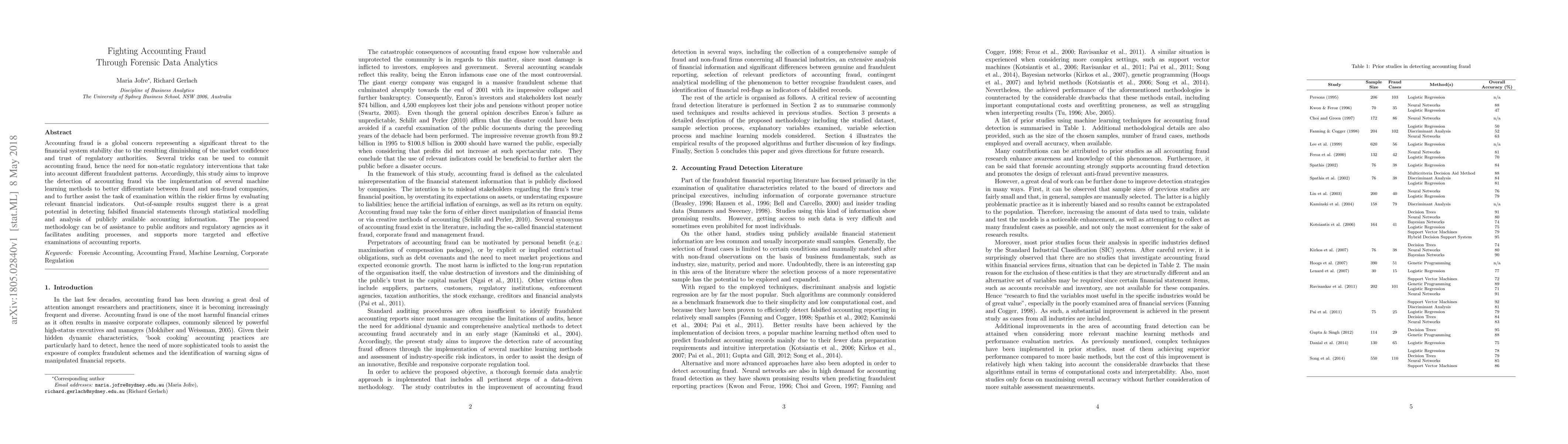

Accounting fraud is a global concern representing a significant threat to the financial system stability due to the resulting diminishing of the market confidence and trust of regulatory authorities. Several tricks can be used to commit accounting fraud, hence the need for non-static regulatory interventions that take into account different fraudulent patterns. Accordingly, this study aims to improve the detection of accounting fraud via the implementation of several machine learning methods to better differentiate between fraud and non-fraud companies, and to further assist the task of examination within the riskier firms by evaluating relevant financial indicators. Out-of-sample results suggest there is a great potential in detecting falsified financial statements through statistical modelling and analysis of publicly available accounting information. The proposed methodology can be of assistance to public auditors and regulatory agencies as it facilitates auditing processes, and supports more targeted and effective examinations of accounting reports.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForensic Data Analytics for Anomaly Detection in Evolving Networks

Abdallah Shami, Li Yang, Amine Boukhtouta et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)