Authors

Summary

Reasoning large language models are rapidly evolving across various domains. However, their capabilities in handling complex financial tasks still require in-depth exploration. In this paper, we introduce Fin-R1, a reasoning large language model specifically designed for the financial sector. Fin-R1 is built using a two-stage architecture, leveraging a financial reasoning dataset distilled and processed based on DeepSeek-R1. Through supervised fine-tuning (SFT) and reinforcement learning (RL) training, it demonstrates performance close to DeepSeek-R1 with a parameter size of 7 billion across a range of financial reasoning tasks. It achieves the state-of-the-art (SOTA) in the FinQA and ConvFinQA tasks between those LLMs in our evaluation, surpassing larger models in other tasks as well. Fin-R1 showcases strong reasoning and decision-making capabilities, providing solutions to various problems encountered in the financial domain. Our code is available at https://github.com/SUFE-AIFLM-Lab/Fin-R1.

AI Key Findings

Generated Jun 10, 2025

Methodology

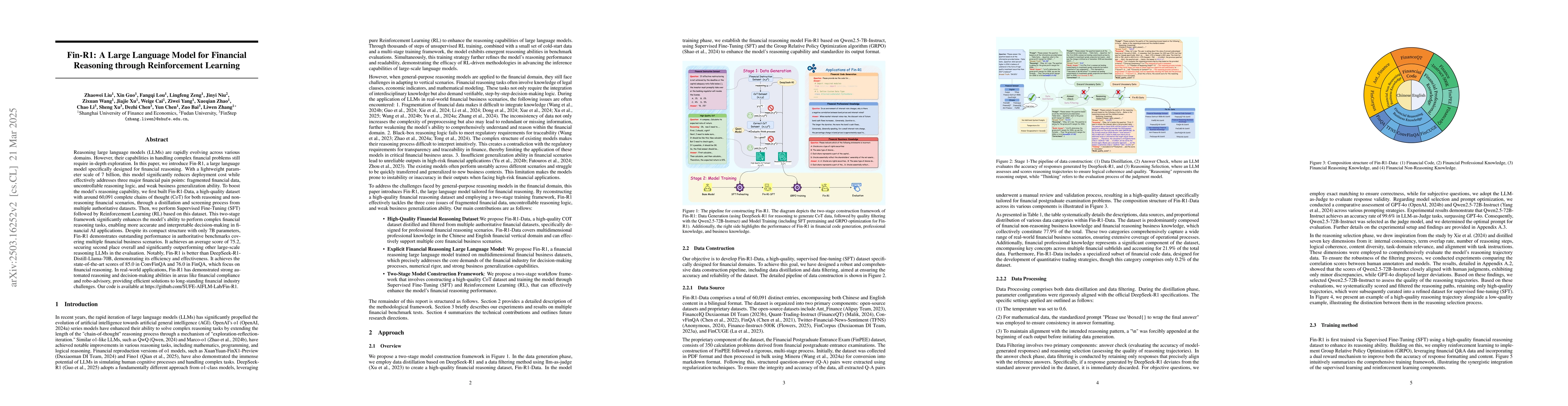

Fin-R1 is a large language model for financial reasoning developed using a two-stage architecture, combining supervised fine-tuning (SFT) and reinforcement learning (RL) with a reward function that balances format correctness and content accuracy.

Key Results

- Fin-R1 achieved state-of-the-art performance on FinQA and ConvFinQA tasks among evaluated models.

- Fin-R1, with 7 billion parameters, outperformed larger models in certain financial tasks and demonstrated strong cross-task generalization capabilities.

- Fin-R1 secured second place overall in a comprehensive benchmarking evaluation covering multiple financial business scenarios.

Significance

This research advances the application of large language models in the financial domain by addressing core challenges such as fragmented financial data, uncontrollable reasoning logic, and weak business generalization ability.

Technical Contribution

Fin-R1 introduces a two-stage training workflow framework for financial domain-specific large language models, combining SFT and RL for enhanced financial reasoning capabilities.

Novelty

Fin-R1 distinguishes itself by focusing on financial reasoning tasks, employing a tailored reward function for format and content accuracy, and demonstrating strong performance despite its lightweight 7B parameter scale.

Limitations

- The model's training data is currently limited to ConvFinQA and FinQA, with plans to expand to more diverse financial datasets.

- The current text-based architecture struggles with financial reports containing visual elements, suggesting a need for multimodal extensions in the future.

Future Work

- Refining the architecture for financial multimodal scenarios and deepening its application exploration in cutting-edge areas.

- Driving widespread adoption of large language models in finance, fostering deeper integration with financial applications to enhance risk management and regulatory compliance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAgentar-Fin-R1: Enhancing Financial Intelligence through Domain Expertise, Training Efficiency, and Advanced Reasoning

Bo Zhang, Wei Wang, Zhiqiang Zhang et al.

DianJin-R1: Evaluating and Enhancing Financial Reasoning in Large Language Models

Chi Zhang, Feng Chen, Qian Chen et al.

Trading-R1: Financial Trading with LLM Reasoning via Reinforcement Learning

Wei Wang, Tong Chen, Di Luo et al.

No citations found for this paper.

Comments (0)