Summary

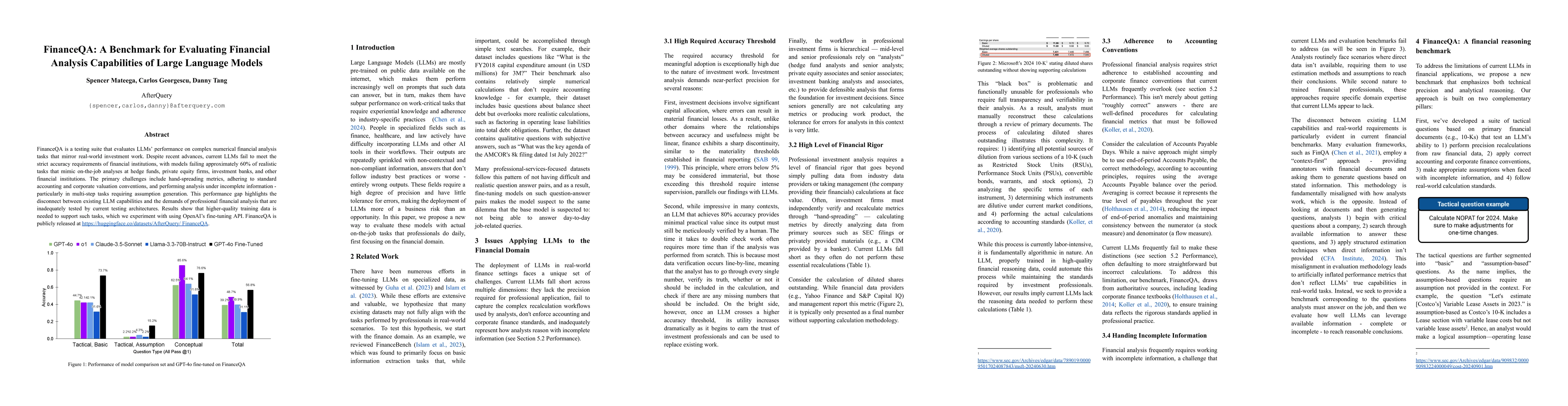

FinanceQA is a testing suite that evaluates LLMs' performance on complex numerical financial analysis tasks that mirror real-world investment work. Despite recent advances, current LLMs fail to meet the strict accuracy requirements of financial institutions, with models failing approximately 60% of realistic tasks that mimic on-the-job analyses at hedge funds, private equity firms, investment banks, and other financial institutions. The primary challenges include hand-spreading metrics, adhering to standard accounting and corporate valuation conventions, and performing analysis under incomplete information - particularly in multi-step tasks requiring assumption generation. This performance gap highlights the disconnect between existing LLM capabilities and the demands of professional financial analysis that are inadequately tested by current testing architectures. Results show that higher-quality training data is needed to support such tasks, which we experiment with using OpenAI's fine-tuning API. FinanceQA is publicly released at [this https URL](https://huggingface.co/datasets/AfterQuery/FinanceQA).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersSECQUE: A Benchmark for Evaluating Real-World Financial Analysis Capabilities

Eitam Sheetrit, Moshik Mishaeli, Oded Ovadia et al.

Golden Touchstone: A Comprehensive Bilingual Benchmark for Evaluating Financial Large Language Models

Jia Li, Chengjin Xu, Yiyan Qi et al.

AstroMMBench: A Benchmark for Evaluating Multimodal Large Language Models Capabilities in Astronomy

Yuyang Li, Yanxia Zhang, Jinghang Shi et al.

AICrypto: A Comprehensive Benchmark For Evaluating Cryptography Capabilities of Large Language Models

Yu Wang, Rongwu Xu, Wenjie Li et al.

No citations found for this paper.

Comments (0)