Summary

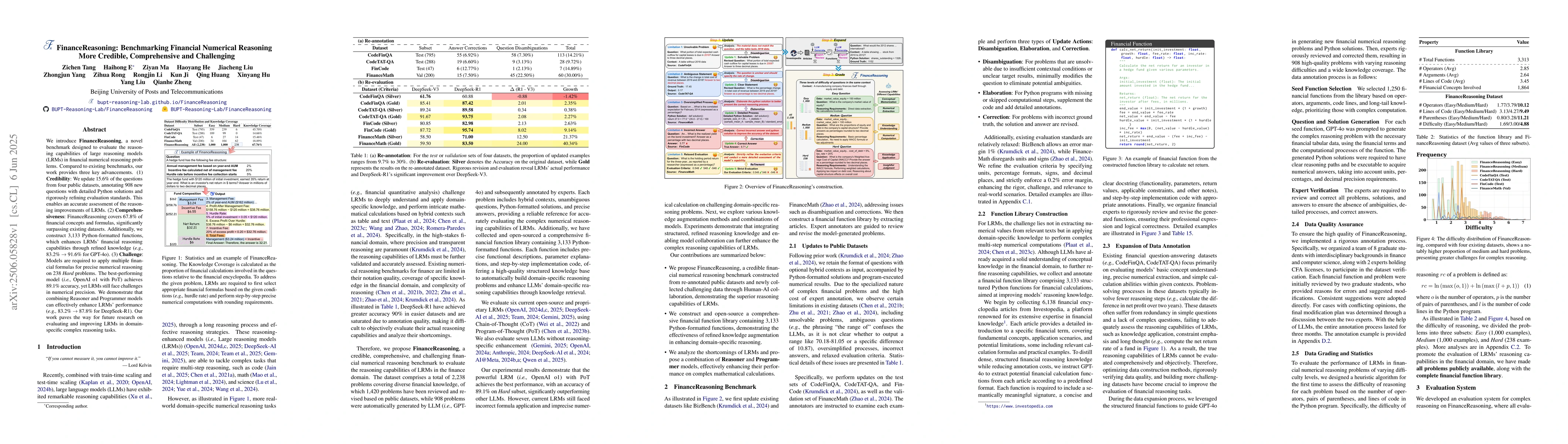

We introduce FinanceReasoning, a novel benchmark designed to evaluate the reasoning capabilities of large reasoning models (LRMs) in financial numerical reasoning problems. Compared to existing benchmarks, our work provides three key advancements. (1) Credibility: We update 15.6% of the questions from four public datasets, annotating 908 new questions with detailed Python solutions and rigorously refining evaluation standards. This enables an accurate assessment of the reasoning improvements of LRMs. (2) Comprehensiveness: FinanceReasoning covers 67.8% of financial concepts and formulas, significantly surpassing existing datasets. Additionally, we construct 3,133 Python-formatted functions, which enhances LRMs' financial reasoning capabilities through refined knowledge (e.g., 83.2% $\rightarrow$ 91.6% for GPT-4o). (3) Challenge: Models are required to apply multiple financial formulas for precise numerical reasoning on 238 Hard problems. The best-performing model (i.e., OpenAI o1 with PoT) achieves 89.1% accuracy, yet LRMs still face challenges in numerical precision. We demonstrate that combining Reasoner and Programmer models can effectively enhance LRMs' performance (e.g., 83.2% $\rightarrow$ 87.8% for DeepSeek-R1). Our work paves the way for future research on evaluating and improving LRMs in domain-specific complex reasoning tasks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinQA: A Dataset of Numerical Reasoning over Financial Data

William Yang Wang, Wenhu Chen, Zhiyu Chen et al.

Numerical Reasoning for Financial Reports

Abhinav Arun, Mehul Soni, Ashish Dhiman et al.

No citations found for this paper.

Comments (0)