Summary

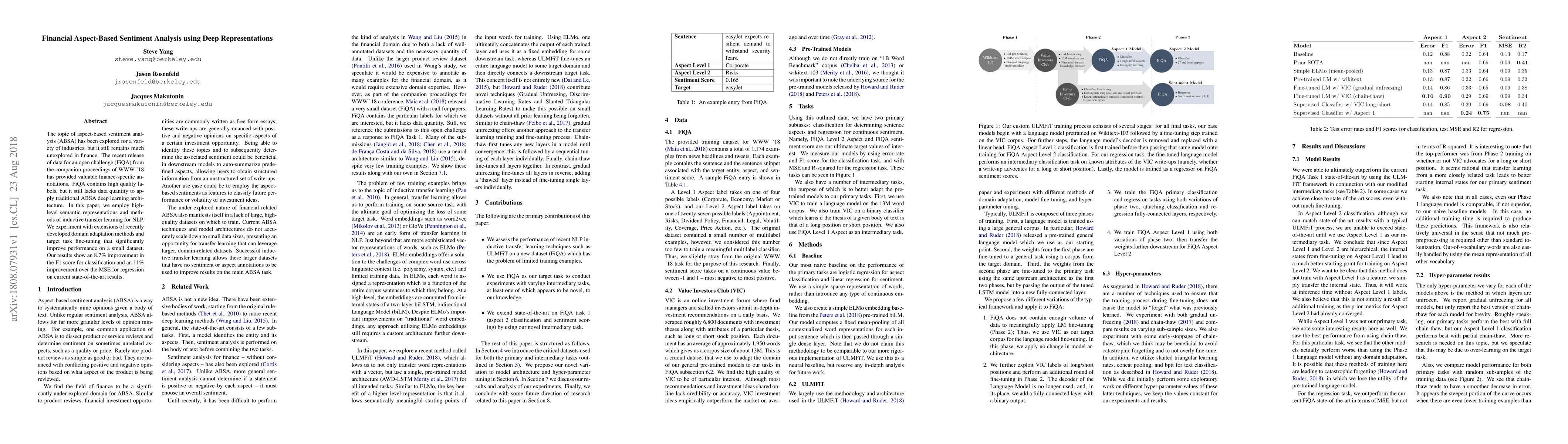

The topic of aspect-based sentiment analysis (ABSA) has been explored for a variety of industries, but it still remains much unexplored in finance. The recent release of data for an open challenge (FiQA) from the companion proceedings of WWW '18 has provided valuable finance-specific annotations. FiQA contains high quality labels, but it still lacks data quantity to apply traditional ABSA deep learning architecture. In this paper, we employ high-level semantic representations and methods of inductive transfer learning for NLP. We experiment with extensions of recently developed domain adaptation methods and target task fine-tuning that significantly improve performance on a small dataset. Our results show an 8.7% improvement in the F1 score for classification and an 11% improvement over the MSE for regression on current state-of-the-art results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinXABSA: Explainable Finance through Aspect-Based Sentiment Analysis

Gianmarco Mengaldo, Erik Cambria, Keane Ong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)