Authors

Summary

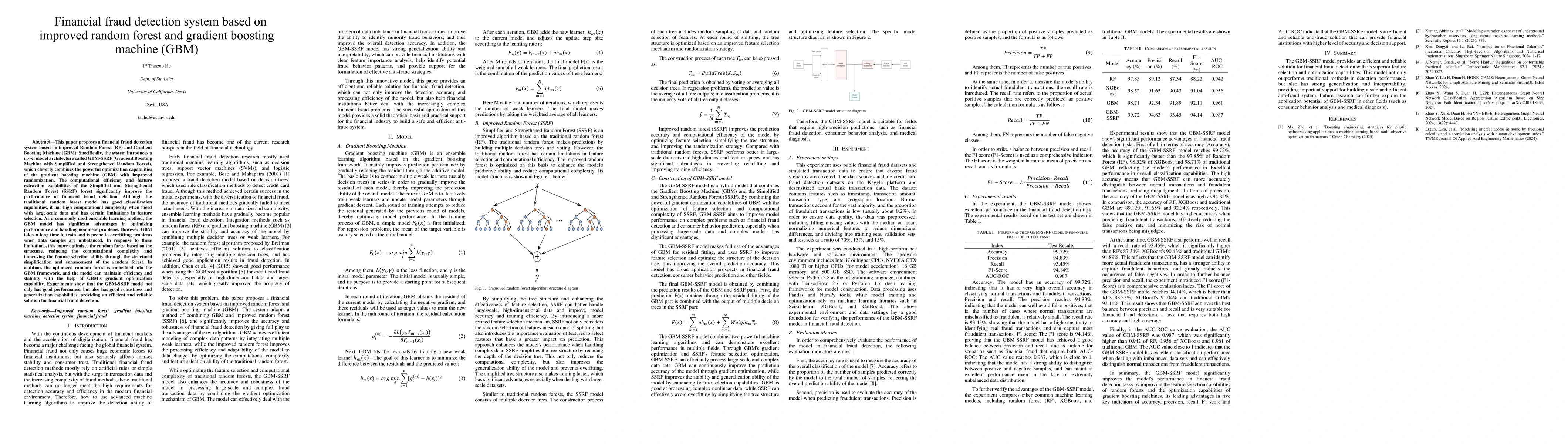

This paper proposes a financial fraud detection system based on improved Random Forest (RF) and Gradient Boosting Machine (GBM). Specifically, the system introduces a novel model architecture called GBM-SSRF (Gradient Boosting Machine with Simplified and Strengthened Random Forest), which cleverly combines the powerful optimization capabilities of the gradient boosting machine (GBM) with improved randomization. The computational efficiency and feature extraction capabilities of the Simplified and Strengthened Random Forest (SSRF) forest significantly improve the performance of financial fraud detection. Although the traditional random forest model has good classification capabilities, it has high computational complexity when faced with large-scale data and has certain limitations in feature selection. As a commonly used ensemble learning method, the GBM model has significant advantages in optimizing performance and handling nonlinear problems. However, GBM takes a long time to train and is prone to overfitting problems when data samples are unbalanced. In response to these limitations, this paper optimizes the random forest based on the structure, reducing the computational complexity and improving the feature selection ability through the structural simplification and enhancement of the random forest. In addition, the optimized random forest is embedded into the GBM framework, and the model can maintain efficiency and stability with the help of GBM's gradient optimization capability. Experiments show that the GBM-SSRF model not only has good performance, but also has good robustness and generalization capabilities, providing an efficient and reliable solution for financial fraud detection.

AI Key Findings

Generated Jun 11, 2025

Methodology

The paper proposes a financial fraud detection system, GBM-SSRF, combining Gradient Boosting Machine (GBM) with an improved Random Forest (SSRF). GBM optimizes performance and handles nonlinear problems, while SSRF simplifies and strengthens Random Forest, improving computational efficiency and feature selection.

Key Results

- GBM-SSRF model achieved 99.72% accuracy, 94.83% precision, 93.45% recall, and 0.987 AUC-ROC in financial fraud detection tasks.

- GBM-SSRF outperformed Random Forest, XGBoost, and traditional GBM in accuracy, precision, recall, F1-score, and AUC-ROC.

- GBM-SSRF demonstrated strong robustness and generalization capabilities, providing an efficient and reliable solution for financial fraud detection.

Significance

This research presents an innovative model, GBM-SSRF, that significantly improves financial fraud detection performance, offering higher accuracy, robustness, and generalization capabilities to support financial institutions in combating complex fraud issues.

Technical Contribution

The paper introduces the GBM-SSRF model, which combines the advantages of GBM and SSRF to optimize feature selection and gradient optimization, leading to improved financial fraud detection performance.

Novelty

The novelty of this work lies in the development of the GBM-SSRF model, which effectively addresses the limitations of traditional Random Forest and GBM models by enhancing computational efficiency and feature selection, resulting in superior financial fraud detection capabilities.

Limitations

- The paper does not discuss potential challenges in deploying the model in real-world, large-scale financial systems.

- Limited information on the computational resources required for training and deploying the GBM-SSRF model.

Future Work

- Investigate the scalability and adaptability of GBM-SSRF for diverse financial fraud scenarios and datasets.

- Explore the integration of GBM-SSRF with other machine learning techniques for enhanced fraud detection performance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInductive inference of gradient-boosted decision trees on graphs for insurance fraud detection

Tim Verdonck, Wouter Verbeke, Bruno Deprez et al.

Efficient Fraud Detection Using Deep Boosting Decision Trees

Yao Wang, Kaidong Wang, Biao Xu et al.

MT-GBM: A Multi-Task Gradient Boosting Machine with Shared Decision Trees

Changhua Meng, Weiqiang Wang, Zhifeng Li et al.

FD4QC: Application of Classical and Quantum-Hybrid Machine Learning for Financial Fraud Detection A Technical Report

Luca Pajola, Matteo Cardaioli, Luca Marangoni et al.

No citations found for this paper.

Comments (0)