Authors

Summary

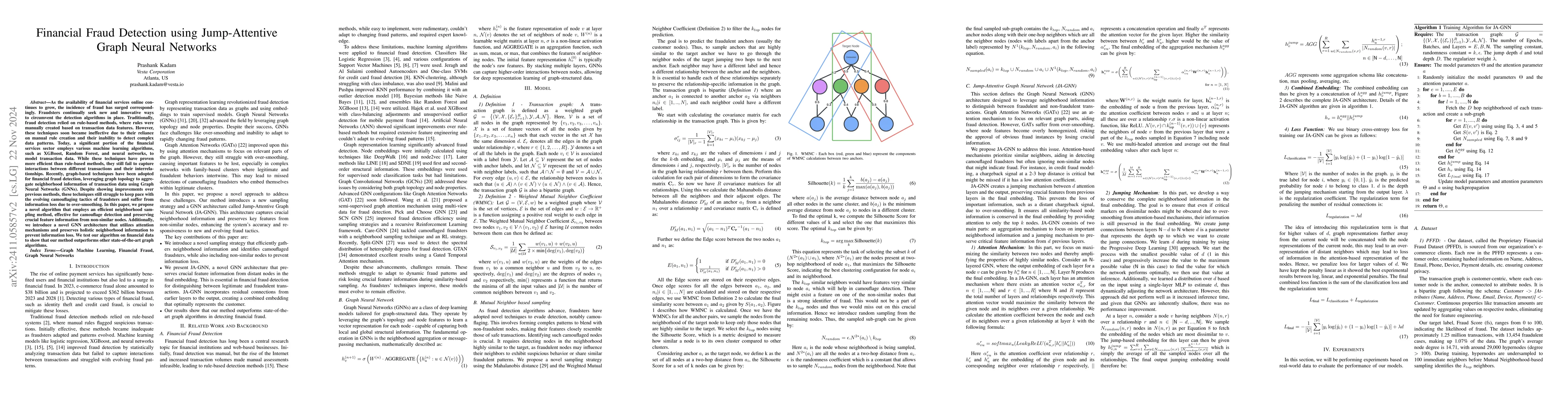

As the availability of financial services online continues to grow, the incidence of fraud has surged correspondingly. Fraudsters continually seek new and innovative ways to circumvent the detection algorithms in place. Traditionally, fraud detection relied on rule-based methods, where rules were manually created based on transaction data features. However, these techniques soon became ineffective due to their reliance on manual rule creation and their inability to detect complex data patterns. Today, a significant portion of the financial services sector employs various machine learning algorithms, such as XGBoost, Random Forest, and neural networks, to model transaction data. While these techniques have proven more efficient than rule-based methods, they still fail to capture interactions between different transactions and their interrelationships. Recently, graph-based techniques have been adopted for financial fraud detection, leveraging graph topology to aggregate neighborhood information of transaction data using Graph Neural Networks (GNNs). Despite showing improvements over previous methods, these techniques still struggle to keep pace with the evolving camouflaging tactics of fraudsters and suffer from information loss due to over-smoothing. In this paper, we propose a novel algorithm that employs an efficient neighborhood sampling method, effective for camouflage detection and preserving crucial feature information from non-similar nodes. Additionally, we introduce a novel GNN architecture that utilizes attention mechanisms and preserves holistic neighborhood information to prevent information loss. We test our algorithm on financial data to show that our method outperforms other state-of-the-art graph algorithms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinancial Fraud Detection using Quantum Graph Neural Networks

Mohamed Bennai, Nouhaila Innan, Siddhant Dutta et al.

Dynamic Relation-Attentive Graph Neural Networks for Fraud Detection

Jinhyeok Choi, Heehyeon Kim, Joyce Jiyoung Whang

Graph Neural Networks for Financial Fraud Detection: A Review

Changjun Jiang, Dawei Cheng, Sheng Xiang et al.

No citations found for this paper.

Comments (0)