Authors

Summary

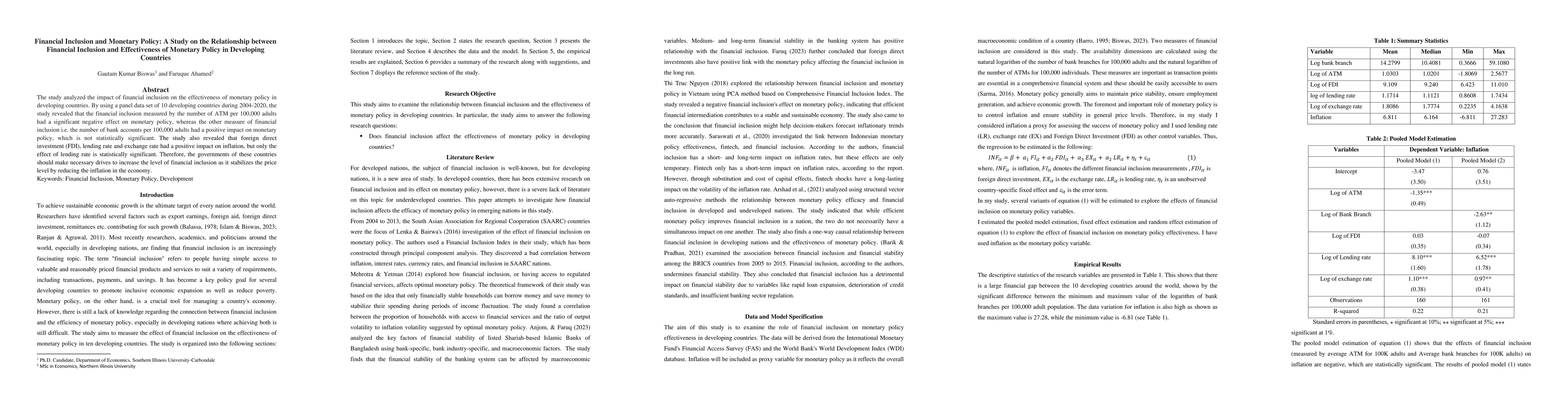

The study analyzed the impact of financial inclusion on the effectiveness of monetary policy in developing countries. By using a panel data set of 10 developing countries during 2004-2020, the study revealed that the financial inclusion measured by the number of ATM per 100,000 adults had a significant negative effect on monetary policy, whereas the other measure of financial inclusion i.e. the number of bank accounts per 100,000 adults had a positive impact on monetary policy, which is not statistically significant. The study also revealed that foreign direct investment (FDI), lending rate and exchange rate had a positive impact on inflation, but only the effect of lending rate is statistically significant. Therefore, the governments of these countries should make necessary drives to increase the level of financial inclusion as it stabilizes the price level by reducing the inflation in the economy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)