Authors

Summary

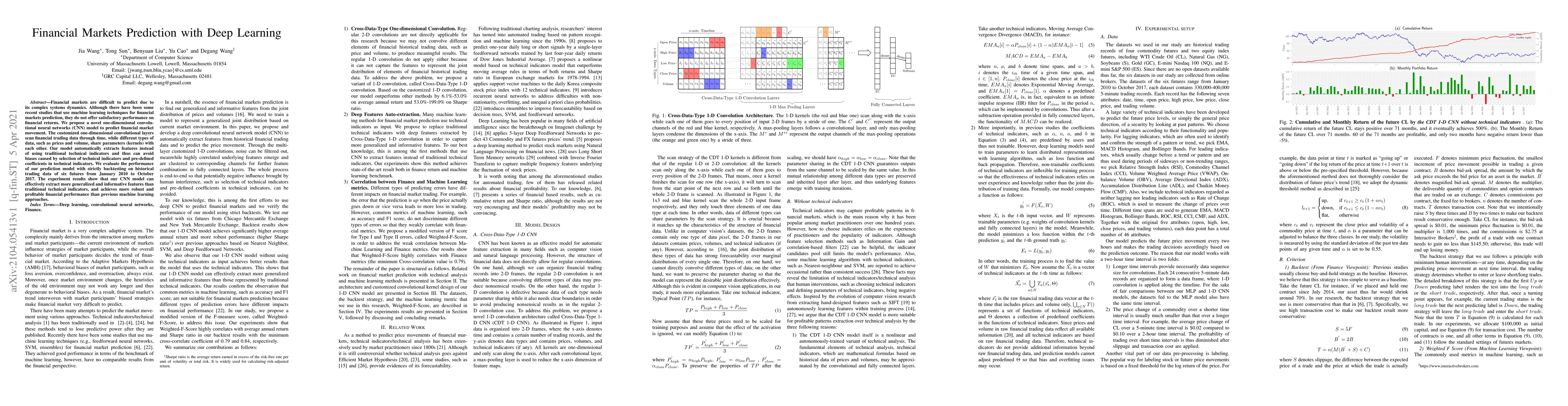

Financial markets are difficult to predict due to its complex systems dynamics. Although there have been some recent studies that use machine learning techniques for financial markets prediction, they do not offer satisfactory performance on financial returns. We propose a novel one-dimensional convolutional neural networks (CNN) model to predict financial market movement. The customized one-dimensional convolutional layers scan financial trading data through time, while different types of data, such as prices and volume, share parameters (kernels) with each other. Our model automatically extracts features instead of using traditional technical indicators and thus can avoid biases caused by selection of technical indicators and pre-defined coefficients in technical indicators. We evaluate the performance of our prediction model with strictly backtesting on historical trading data of six futures from January 2010 to October 2017. The experiment results show that our CNN model can effectively extract more generalized and informative features than traditional technical indicators, and achieves more robust and profitable financial performance than previous machine learning approaches.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalysis of Financial Risk Behavior Prediction Using Deep Learning and Big Data Algorithms

Zhaoyang Zhang, Haowei Yang, Ao Xiang et al.

Dual-CLVSA: a Novel Deep Learning Approach to Predict Financial Markets with Sentiment Measurements

Yu Cao, Jia Wang, Benyuan Liu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)